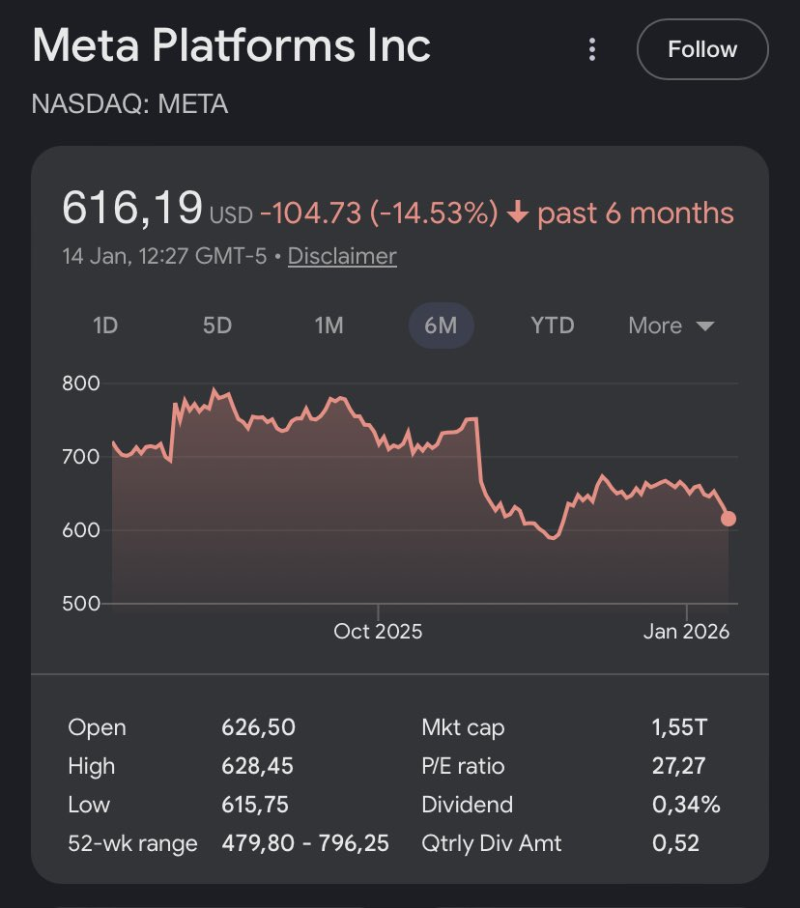

⬤ Meta Platforms Inc. (META) has taken a hit lately, dropping 14.53% over the past six months. The stock's sitting at $616.19 as of January 14, 2026 – a far cry from its $796.25 peak. But here's the thing: despite this pullback, Meta's still crushing it in the AI-driven social media game. That 20x forward earnings multiple? That's looking pretty attractive right now, and some analysts are calling it a steal.

⬤ Meta's perfectly positioned to ride the AI wave in social networking. Sure, the market's been choppy, but the company's bread and butter – connecting people and building communities – isn't going anywhere. History shows that scooping up META when it trades below 20x forward earnings has been a winning move. The company's massive user base and social media dominance give it serious staying power, even when things get rocky.

⬤ The recent stock slide comes down to macro headwinds and industry challenges, but Meta's cash flow machine keeps humming along. The company's still the king of social networking, and AI integration could be the next big catalyst. As these technologies level up, Meta's platform could deliver better user experiences and unlock new revenue streams – exactly the kind of thing that pushes stocks higher over time.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi