⬤ Meta Platforms' earnings picture looks dramatically better once you strip out a one-time tax hit. The company's trailing twelve-month EPS has staged a sharp recovery from 2023 lows and continued climbing into 2025. Removing that temporary tax impact completely reshapes how investors should view META's valuation against its growth momentum.

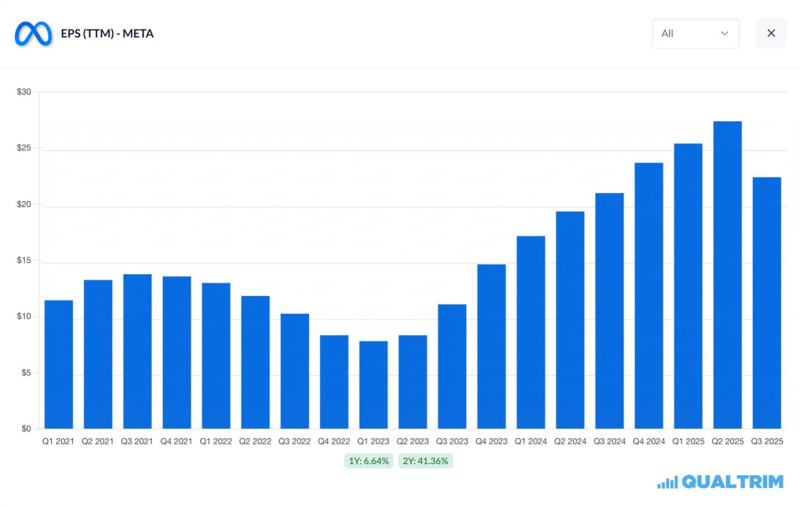

⬤ The EPS trajectory tells the story: earnings dropped through 2022, stabilized in early 2023, then accelerated throughout 2024 and 2025. EPS climbed from under $10 during the recovery phase to above $25 by mid-2025—more than doubling in roughly two years. While recent data shows a slight pullback, earnings remain dramatically higher than previous cycle peaks.

⬤ Revenue growth backs up these earnings gains. Meta posted 26.25% year-over-year revenue growth, proving that EPS expansion stems from real operational momentum rather than just temporary cost cuts. On an adjusted basis, META trades at roughly 22 times earnings—a relatively modest multiple considering the company's growth rate.

Peter Smith

Peter Smith

Peter Smith

Peter Smith