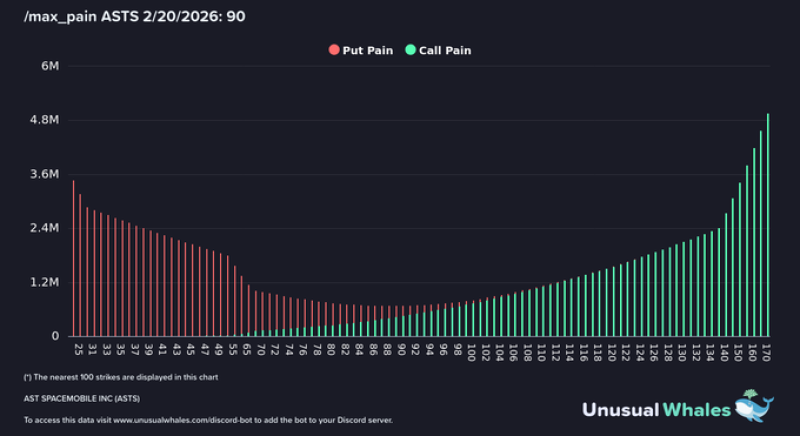

⬤AST SpaceMobile (ASTS) is drawing attention into the Feb. 20 options expiry as positioning concentrates around a key strike. ASTS was trading near $81.50, about $8.50 below the $90 max pain level. The options chart highlights the $90 area as a central magnet zone, with downside exposure heavier at lower strikes and upside call exposure building above current price. Read more: ASTS holds max pain level as call interest builds.

⬤The put-call distribution tells a clear story. Puts dominate from the $20s through the mid-$70s, then thin out as strikes approach spot — framed more as fading protection than a concentrated bearish bet near the market. Above spot, call exposure starts taking over and becomes increasingly prominent at higher strikes, setting up a structure where price sensitivity can shift sharply if ASTS approaches the $90 line. Check out the analysis: Trades below max pain as calls stack above.

Call positioning flips the script above $90 and ramps sharply from $100 toward $170 — this could create conditions for larger hedging adjustments if ASTS pushes into the high-$80s and holds above $90.

⬤With expiration approaching, the $90 level is the key reference point for near-term volatility. The combination of heavier put positioning below spot and rising call exposure above creates a setup where trading behavior stays focused around a narrow set of strikes — potentially amplifying moves if price drifts toward the most concentrated zones. More on this dynamic: $90 strike magnet before Feb 20 expiry.

Usman Salis

Usman Salis

Usman Salis

Usman Salis