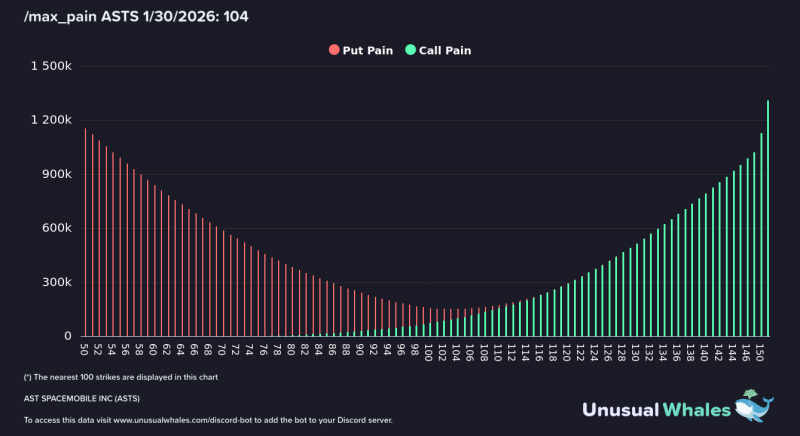

⬤ AST SpaceMobile shares are holding around $104 heading into the January 30 options expiration, sitting right at the calculated max pain point. Both the current price and max pain align at $104, putting ASTS at a crucial options reference level. The options chain shows where exposure is most concentrated going into expiry.

⬤ There's substantial put positioning stacked between the $50 and $90 strikes, well below where ASTS is trading now. This deep out-of-the-money put exposure looks more like insurance than any real expectation of a near-term drop. Put-related pain drops off as strikes move closer to $104, showing limited downside pressure just below current levels.

⬤ Call positioning tells a different story. Starting just above $104, call-related pain increases sharply from around $106 through $155, with exposure nearly doubling across that range. "The options structure suggests that short-term price behavior may remain sensitive to movements above $104," as shifts in dealer hedging can influence momentum near these concentrated strike zones.

⬤ The $104 level matters because price and max pain are perfectly aligned there, while call interest sits above and put positioning stays distant below. If ASTS pushes higher, dealer hedging activity could amplify moves as the price approaches those concentrated call strikes in the options market.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah