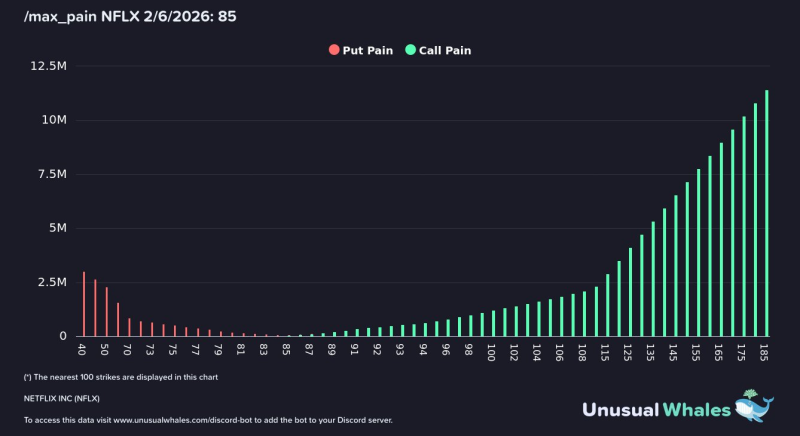

⬤ NFLX is hovering around $82 with max pain at $85—that $3 gap matters heading into the February 6 expiry. The options board is lopsided, with calls dominating everything above current levels. That spread between where the stock sits and where max pain lives puts Netflix in a zone where dealer flows could start moving the needle as expiration gets closer.

⬤ Put positioning tells most of its story down low—peak interest sits in the low $70s, then falls off a cliff as you move higher. Past that zone, downside bets basically disappear, meaning there's barely any bearish hedging anywhere near the current price. Most of the put action is positioned way below spot, and nearer-term protection has dried up going into expiry.

Netflix is trading roughly $3 below max pain, placing the stock in a zone where options-related flows could become more influential.

⬤ Call positioning flips the script above $85. Below max pain, call interest is thin. Once you cross that line, it ramps fast—call open interest explodes past $100 and keeps climbing, with exposure topping 12 million contracts at the highest strikes shown. That's a heavily tilted board pointing straight up.

⬤ Max pain levels and skewed positioning like this can mess with short-term price action around expiry. With NFLX just under $85 and calls stacked hard above it, any move higher could get amplified through dealer adjustments. Puts fading out while calls pile up makes the $85 zone critical for how Netflix behaves into February 6.

Peter Smith

Peter Smith

Peter Smith

Peter Smith