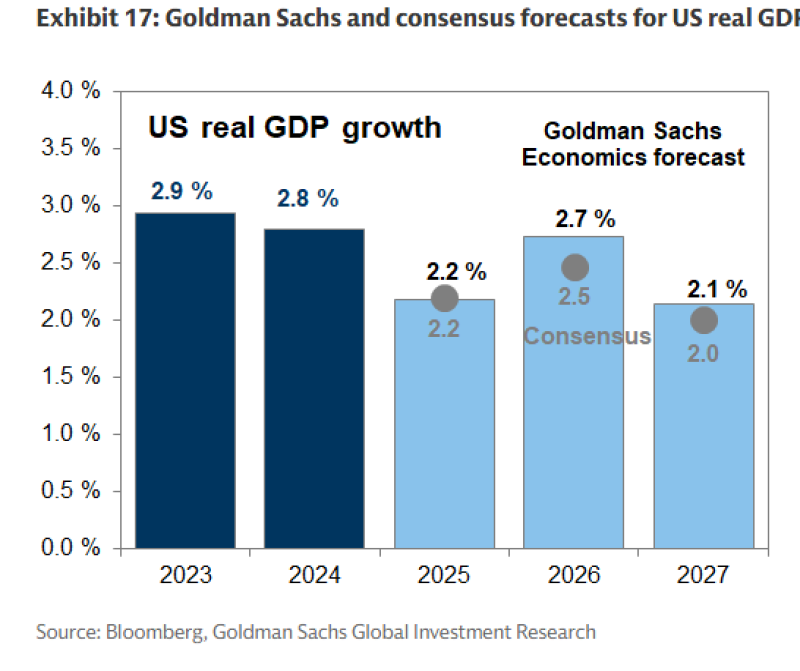

⬤ Fresh forecasts for U.S. real GDP growth are getting attention as projections point to firmer momentum in 2026 compared to 2025. A 2.5% real GDP outcome would actually represent an acceleration versus Goldman Sachs' own 2025 estimate. The data, sourced from Bloomberg and Goldman Sachs Global Investment Research, lays out both firm forecasts and consensus expectations across 2023-2027.

⬤ The numbers tell a clear story: the U.S. economy grew 2.9% in 2023 and 2.8% in 2024, before losing some steam at 2.2% in 2025 - a reading both Goldman and the broader consensus agree on. Then comes the split. For 2026, Goldman Sachs puts growth at 2.7%, while the consensus sits at 2.5%. Either way, both figures beat the 2025 pace, which is the core takeaway here.

⬤ After 2026, the picture cools again. Goldman Sachs projects 2.1% growth in 2027, with consensus right behind at 2.0%. So the broad arc looks like this: dip in 2025, rebound in 2026, then a gradual glide back toward the 2% zone. It's not a dramatic swing - more of a re-acceleration window before things normalize.

⬤ Why does this matter? GDP expectations shape everything from earnings outlooks to Fed rate assumptions and overall risk sentiment. With consensus at 2.5% and Goldman at 2.7% for 2026, the baseline for U.S. growth looks reasonably constructive despite the 2025 soft patch. The gap between the two forecasts also reflects an ongoing debate about how durable this expansion really is once the slowdown dust settles.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah