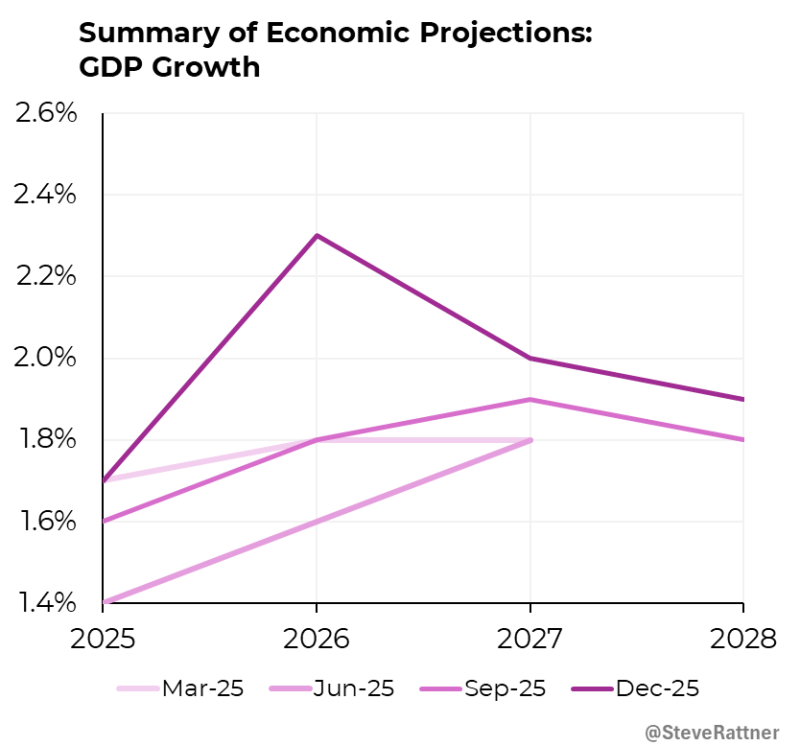

⬤ The Federal Reserve has raised its 2026 growth forecast to 2.3 % GDP, up from the 1.8 % it gave in September. That half point jump is large. A new Fed chart lines up the March, June, September besides December numbers - each later release sits higher than the one before it.

⬤ The December line climbs to the 2.3 % high point for 2026 then eases lower in 2027 and 2028. The March track began at 1.4 % and peaked at only 1.8 % in 2027. The June or September tracks were stronger - yet they still fell short of the latest mark. Officials now believe the growth drivers are sturdier than they judged last autumn.

⬤ Even after the 2026 peak the December track lands at 1.9 % for 2028, a level that stays above every earlier path. The change mirrors labour market figures plus consumer-spend figures that improved through 2025 - the Fed trusts the expansion will last.

⬤ The revision is not a set of abstract digits. A firmer growth path alters policy choices, market views and investor risk gauges. When the Fed expects faster output, questions about inflation timing and rate-cut timing shift. With the new forecast, markets must redraw their map of the next two years.

Usman Salis

Usman Salis

Usman Salis

Usman Salis