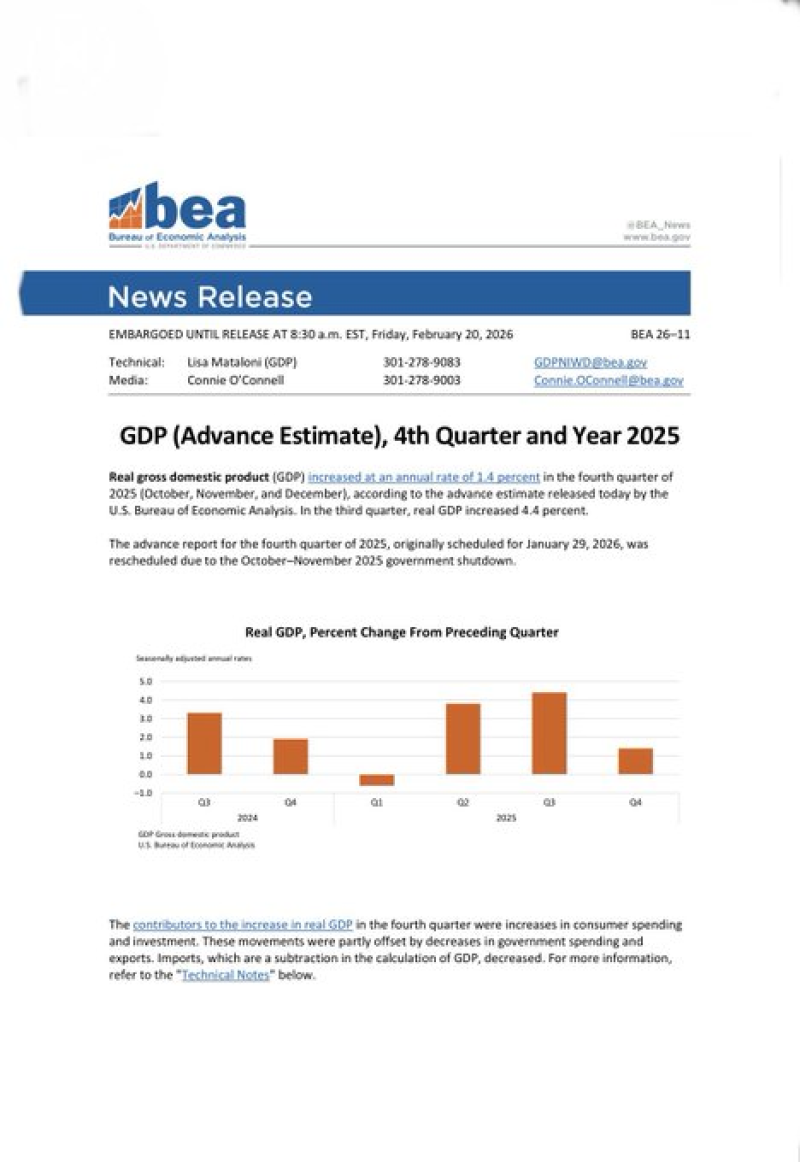

⬤ The Bureau of Economic Analysis reported that U.S. real GDP rose at a 1.4% seasonally adjusted annual rate in Q4 2025, down sharply from 4.4% in Q3. As @onechancefreedm noted, the headline number matters - but what sits beneath it is what markets tend to use when judging whether growth is durable or turning defensive. Nominal U.S. GDP came in at 5.1%, while real final sales to private domestic purchasers - a cleaner read on underlying demand - rose 2.4%.

⬤ Breaking down how the economy got to 1.4%: consumer spending added 1.58 percentage points, gross private domestic investment contributed 0.66 points, and net exports added 0.08 points partly because imports fell. Government spending subtracted 0.90 points - a meaningful drag. Within consumer activity, services did the heavy lifting. PCE services contributed 1.59 points while PCE goods were essentially flat at minus 0.01. The biggest service drivers were classic "bill-paying" categories: health care at 0.63 points, housing and utilities at 0.24, and financial services and insurance at 0.22.

⬤ Cyclical stress showed up most clearly in autos and construction. Motor vehicle output fell 44.1% SAAR, subtracting 1.41 percentage points from GDP - strip that out and growth would have been closer to 2.9%. Residential investment dropped 1.5% SAAR and nonresidential structures fell 2.4% SAAR. Trade sent a mixed signal: exports were down 0.9% while imports fell 1.3%, and weaker imports mechanically lift U.S. economic growth figures even as they hint that domestic demand is cooling.

⬤ Household buffers are thinning. Real disposable personal income rose just 0.1%, the saving rate slipped to 3.6% from 4.2%, and personal saving fell to $841B from $955B. The report also carried unusual noise: a government shutdown distortion accounted for a 1.0 percentage point subtraction from GDP growth. With real growth slowing, core PCE inflation still elevated, and cyclicals weakening, Q4 frames the U.S. economy as resilient on essentials but more fragile in rate-sensitive and credit-sensitive areas - a setup that's likely to keep influencing USD sentiment as traders weigh slowdown risk against sticky inflation.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi