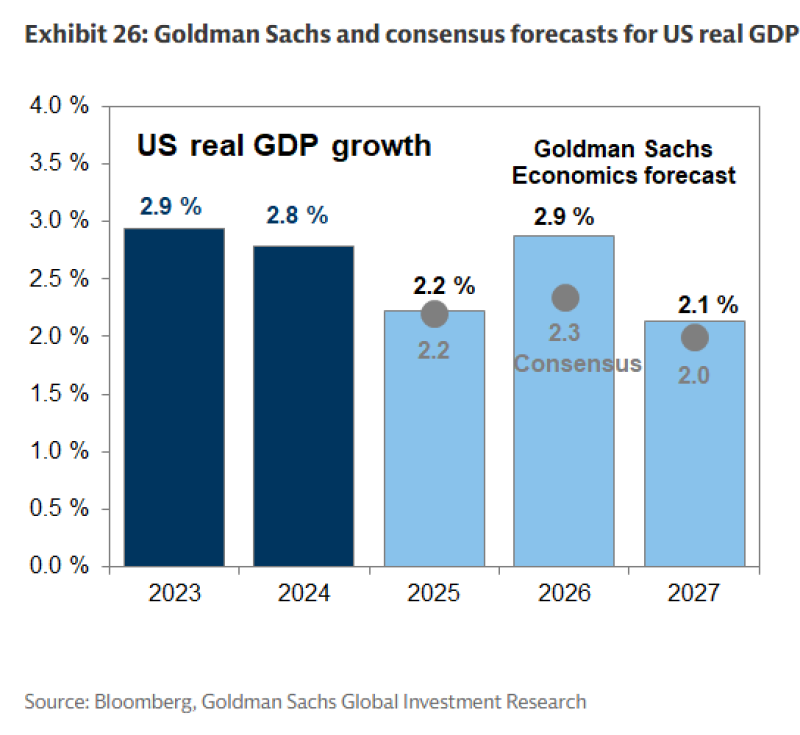

⬤ Goldman Sachs just rolled out fresh projections for US real GDP growth, and the story they're telling is one of slowdown followed by comeback. The bank sees growth cooling off in the near term before picking back up, ultimately reaching 2.9 percent as the economy finds its footing again. Their forecast sits notably above what most analysts are expecting, suggesting Goldman's taking a more optimistic view on how things will shake out.

⬤ Here's how the numbers break down: US real GDP growth came in at 2.9 percent in 2023, then dipped slightly to 2.8 percent in 2024. Goldman expects that momentum to ease further to around 2.2 percent in 2025 as tighter financial conditions and the fading post-pandemic boost take their toll. Most forecasters see something similar for next year, so there's general agreement that we're heading into a softer stretch—though not a nosedive.

⬤ But here's where Goldman stands apart: they're predicting growth will snap back to 2.9 percent in 2026, well above the consensus estimate of 2.3 percent. "The US economy may experience a softer patch rather than a sharp contraction," according to their analysis, which points to underlying resilience that could surprise to the upside. Looking further out to 2027, they see growth settling back to about 2.1 percent, right in line with long-term trends and close to what everyone else is forecasting at 2.0 percent.

⬤ Why does this matter? Because US growth drives everything from Fed policy decisions to corporate profit expectations and global market sentiment. If we get the moderation-then-reacceleration path Goldman's mapping out, it changes the game for investors trying to position themselves for what comes next. The key will be watching how the data actually plays out and whether that 2026 rebound materializes as strongly as Goldman thinks it will.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova