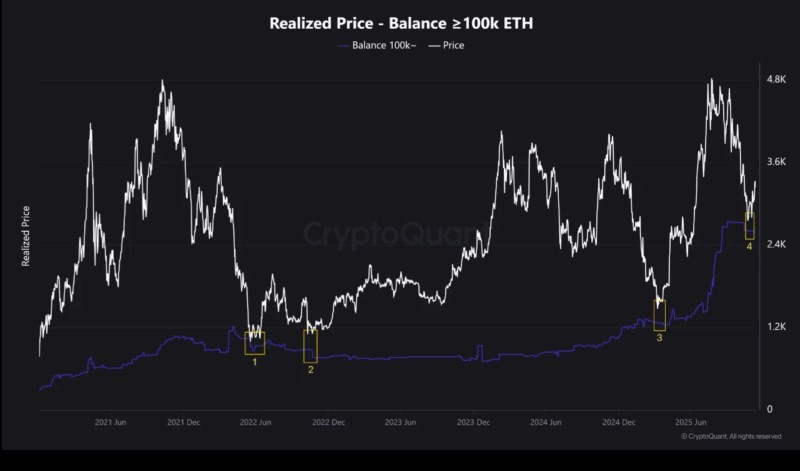

⬤ ETH is currently sitting near the cost basis of whale wallets that hold at least 100,000 ETH. The on-chain data compares Ethereum's market price with the realized price of these massive holders—essentially showing where whales bought in on average. Right now, ETH is trading at a level we haven't seen much of since the 2021 rally took off.

⬤ Looking at historical data, there have been only a few moments where ETH price dropped down to meet the whale realized price. These rare convergence points happened during major drawdowns and long consolidation phases. Since Ethereum's explosive run in 2021, the price has mostly stayed well above where whales accumulated, which makes today's situation pretty unusual.

⬤ Recent price movement shows ETH sliding back toward this key on-chain level. The whale realized price has been gradually climbing over time as big holders continue accumulating at higher levels, but market volatility keeps pulling ETH back down to test these support zones. The data doesn't predict which way price will move next—it just shows how close we are to whale entry levels right now.

⬤ This matters because the realized price of major holders acts as a crucial benchmark for understanding market structure. When ETH trades near the average cost of whales, it typically means long-term conviction is being tested. Given how rarely this has occurred since 2021, the current setup represents a significant on-chain development for Ethereum's market cycle.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov