In the tax field, precision and ease are paramount. That is where TaxRefund.Pro comes in the smartest and the easiest to use Tax Refund Calculator that will help the taxpayers of the UK to reclaim their due. You may be a full-time employee, a freelancer, or somebody who has just left a job; our UK Tax Refund Calculator gives you no opportunity to overlook any chance of getting a refund.

Understanding the Power of the Tax Refund Calculator

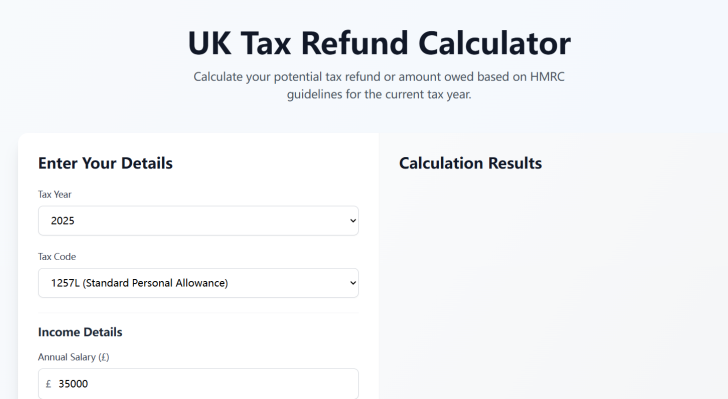

TaxRefund.pro Tax Refund Calculator is both accurate and compliant. It is a correct method of estimating your overpaid tax by comparing your income, deductions, and allowances based on the HMRC standards. Seeing that a few details with your P45 or your P60, you can immediately tell what you can get refunded and how much you can receive.

In contrast to other generic tools, our UK Tax Refund Calculator not only enough calculations but you to see the reasons as to why you are getting a refund. It could be the result of a change in employment in the middle of the year, a change in tax reliefs that have not been claimed, or philanthropic contributions under Gift Aid. The tool has highlighted all the aspects that lead to your refund.

Essential UK Tax Knowledge You Should Know.

The Calculator of the UK Tax Refund is done according to the most recent tax laws of 2023 24. The personal allowance of every UK taxpayer is a sum of 12,570, which implies that at income levels below this amount, a taxpayer will not pay income tax. Any income exceeding this will be taxed in brackets 20% (Basic rate) on an income up to £50270, 40 percent (Higher rate) on an income up to 125140, and 45 percent (Additional rate) after that.

Scotland has its rates, which the calculator automatically changes depending on your region. Moreover, the personal allowance decreases slowly, as long as your income exceeds 100,000, a fact that the Tax Refund Calculator will consider automatically.

You can also claim a refund in case you have overpaid using the PAYE, and you have either left the job in the middle of the year or not taken deductions on expenses, charity, and subscriptions to professions.

Quick and Simple Refund Process

Saving you time and stress with TaxRefund.pro. All you need to do is enter your financial information in the UK Tax Refund Calculator, and in a few seconds, you will have a more accurate estimate of your possible refund. After confirmation, you will be able to get your money back via the HMRC portal, using a Self Assessment. It will normally take between 4 to 6 weeks to process, and you may even claim up to four years of past tax returns.

All the calculations are supported by HMRC standards, which results in 100 percent compliance and accuracy.

Why Choose TaxRefund.pro

- Daily HMRC tax rules compliant.

- Estimation of the real-time refund in seconds.

- Installation is Accurate with PAYE, freelancers, and part-time workers.

- Trustworthy and convenient platform.

- Available both on desktop and mobile.

Conclusion

Navigate the complexities of US taxes and the latest UK tax rates 2024-25 with certainty. TaxRefund.pro delivers accurate, personalized refund calculations—whether you're filing for the first time or reviewing past claims. Stop guessing and secure every dollar and pound you deserve.

Editorial staff

Editorial staff

Editorial staff

Editorial staff