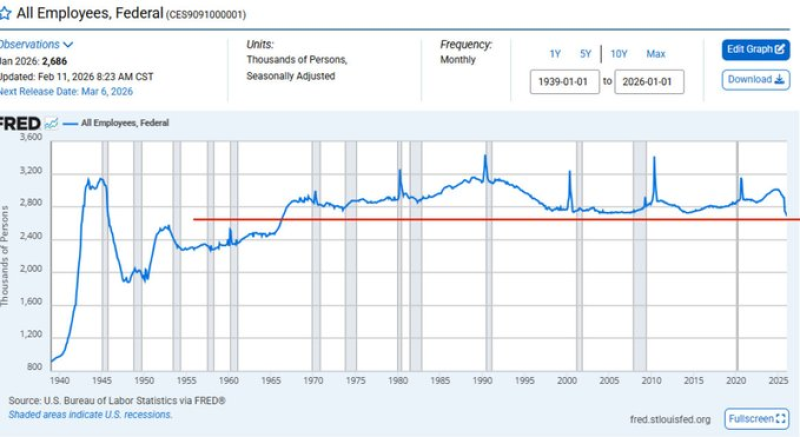

⬤ U.S. federal employment has quietly slipped back to territory last seen in the mid-1960s. Long-term FRED labor data puts the current federal workforce at roughly 2.686 million seasonally adjusted employees — a level that matches the range observed around 1966. It's a notable shift, and one that's starting to get attention from macro watchers tracking where the fiscal picture is headed.

⬤ The FRED series captures decades of fluctuation — temporary hiring surges, recession-era contractions, and long stretches of relative stability. What's different now is the direction: the trend has drifted lower within the long-run range, pulling the total back toward those older baseline levels. The move is tied to broader deficit and debt reduction efforts — though that's a commentary reading of the chart rather than a hard statistical conclusion.

The federal workforce is now near the range observed around 1966 — a notable shift after decades of broadly stable readings.

⬤ This lands in a market environment where labor data is already carrying a lot of weight. TheTradable has been tracking deteriorating labor demand signals and what they mean for macro pricing — including US job openings dropping to 0.87 per worker, a figure that's reshaping rate cut expectations heading into 2026.

⬤ Against that backdrop, a shrinking federal payroll becomes more than a footnote — it's another signal feeding the broader tightening narrative, even without any explicit policy move. That kind of slow-burn pressure tends to show up in risk sentiment across equities like SPY. Related context: US payrolls rising 130K in January despite signs of slowdown, and the case for weaker US jobs data potentially fueling liquidity shifts.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova