The U.S. economy is hitting a turning point as job growth slows down, raising questions about what the Fed will do next with interest rates. For crypto traders watching Bitcoin and altcoins, this slowdown might actually be good news - it could kick off the next bull run.

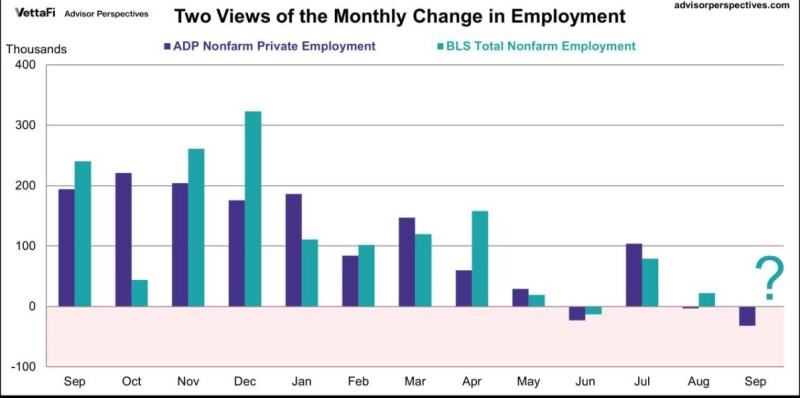

Employment Reports Show Divergence

Recent data shows a clear split between two major employment measures. The ADP nonfarm private employment figures and the BLS total nonfarm numbers both looked strong in late 2023, but since then, hiring has dropped off noticeably. Some months even went negative, which tells you just how much momentum has faded. According to Broke Doomer trader, if over 400,000 federal workers get furloughed during a government shutdown, the labor numbers could get even softer.

That takes pressure off inflation and makes it easier for the Fed to think about cutting rates sooner.

Why This Matters for Markets

When jobs cool down, wages stop climbing as fast, which means less inflation risk. Lower inflation gives the Fed room to cut rates, and rate cuts mean more money flowing into riskier assets like crypto. On top of that, a government shutdown would pause new economic data releases for a while. Without constant surprises hitting the market, traders get a more predictable environment to work with.

Implications for Crypto

Bitcoin's been holding up well lately, and altcoins are sitting near important price levels. If the Fed does ease up and liquidity improves, digital assets could have what they need to break higher. For a lot of traders, this setup looks like the start of a fresh rally.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah