The US labor market just delivered a confusing message. Official numbers from January looked pretty solid on the surface, but dig a little deeper and you'll find warning signs that things might not be as strong as they seem. The question now is whether we're seeing a genuine rebound or just statistical noise masking a slowdown.

January Jobs Report Shows 130K Gain, Unemployment Dips to 4.3%

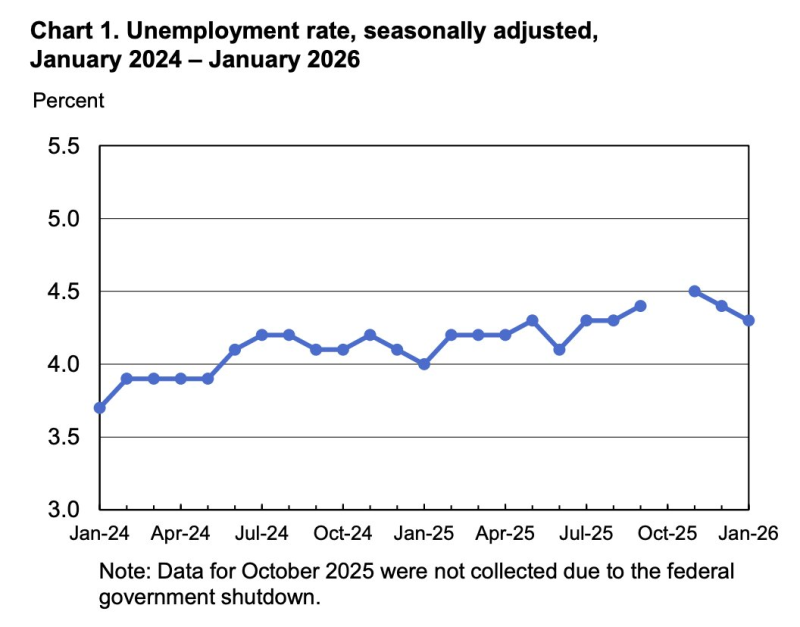

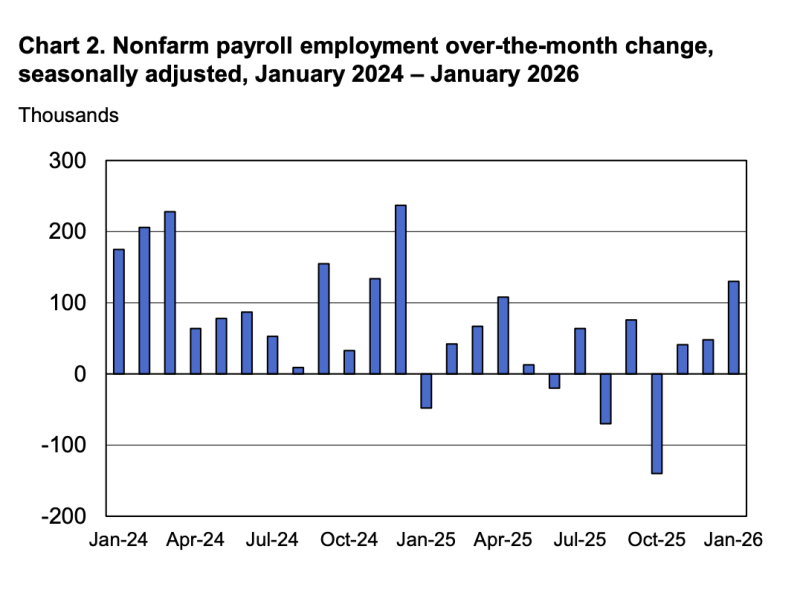

The Employment Situation report revealed non farm payrolls jumped by 130K in January, way better than the 70K economists were expecting and a big improvement from December's weak 48K. The unemployment rate also ticked down slightly to 4.3% from 4.4%, leaving 7.4 million Americans out of work.

But here's where it gets tricky. Even with that improvement, unemployment is still higher than the 4% we saw a year ago when only 6.9 million people were jobless. Several analysts looked at the full picture and called the report weak, suggesting government stats might be missing the real story about how fast the labor market is cooling.

Independent Data Points to Weakening Employment Momentum

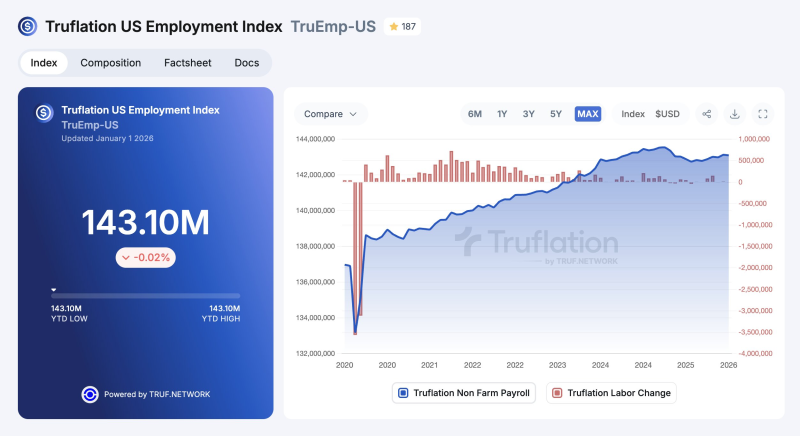

The real disconnect shows up when you compare official data with independent tracking. Truflation's employment index actually estimated payrolls dropped by 13K in January, total opposite of the government's claim. Their data puts total employment around 143.1 million.

The divergence between official reports and real-time data creates serious questions about where employment really stands right now.

Looking at charts going back to 2020, you can see hiring has been expanding overall but the monthly gains keep getting smaller. That pattern screams slowing hiring momentum, especially as AI reshuffles jobs across different sectors.

What This Means for Markets and the Economy

This creates a messy situation for the S&P 500 and broader markets. Strong official payroll numbers would normally be bullish, but signs of underlying weakness tell a different story. The combination of government strength and independent softness highlights major labor market uncertainty about where we are in the economic cycle and where things are headed next.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah