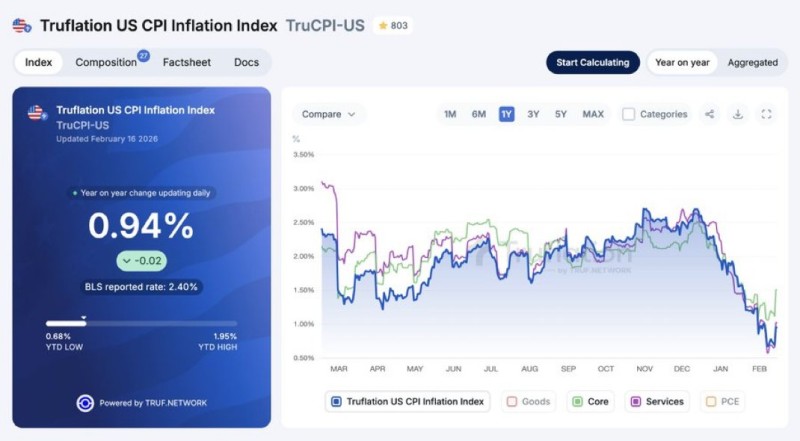

Real-time inflation data is telling a very different story from official government figures. While the BLS continues to report consumer prices running at 2.40%, Truflation's independent tracker has fallen to just 0.94% — raising fresh questions about which measure better reflects what's actually happening in the economy.

A Real-Time Signal the Official Numbers Don't Show

The Truflation US CPI Inflation Index (TruCPI-US) has dropped below 1% — a threshold that tends to turn heads in macro circles. The dashboard now shows a 0.94% year-on-year reading, with the index trending sharply lower into February and hovering near the bottom of its recent range. As DustyBC Crypto reported, this sub-1% print is a notable cooling signal from one of the more closely watched real-time inflation trackers.

What makes this stand out isn't just the number itself — it's the gap. Right next to the TruCPI figure, the dashboard displays the official BLS CPI rate of 2.40%, making the divergence impossible to ignore. The alternative measure has compressed toward the lower end of its annual band, with a 0.68% YTD low and a 1.95% YTD high recorded over the same period.

Similar divergence themes have emerged before — when Truflation CPI plunged while the official BLS CPI stayed higher.

Broad-Based Decline Across Goods, Services, and PCE

The chart tells a broader story too. Multiple tracked components — goods, core, services, and PCE — appear to roll over together in the latest downswing, which means this isn't just a quirk in one category. The decline looks broad-based. Has previously flagged comparable signals when independent CPI-style data pointed to sub-1% inflation ahead of official releases.

Why does any of this matter? Because inflation expectations shape policy outlook and cross-asset sentiment — particularly when alternative high-frequency measures start diverging significantly from official benchmarks. Has framed this dynamic through the lens of a widening inflation gap, where real-time CPI and PCE measures track well below BLS readings. When that gap grows, it tends to fuel debate about whether official data is lagging reality — and that debate has consequences for rate expectations, bond markets, and risk appetite across the board.

Usman Salis

Usman Salis

Usman Salis

Usman Salis