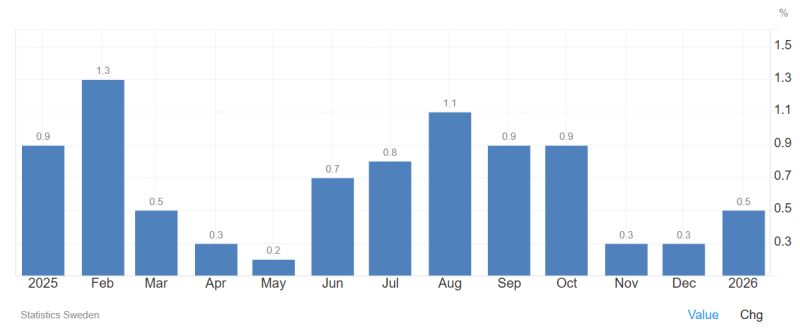

⬤ Sweden's inflation came in at 0.5% year over year in January, missing the 2% target by a wide margin. M3 money supply growth clocked in at 3.2% annually. As Steve Hanke noted, both numbers sit below his 5.8% Golden Growth Rate, the pace he argues is needed to consistently hit the inflation objective. In his view, this is a liquidity story, not a mystery.

⬤ The visual framing makes the point plainly. Sweden's inflation is labeled "cold" at 0.5%, M3 sits at 3.2%, and both fall short of the 5.8% Golden Growth Rate benchmark alongside the 2% target marker. The gap between actual money growth and that benchmark is the core of the argument for why inflation is underperforming.

Money growth running cooler than the benchmark tied to stable price gains.

⬤ This isn't just a Sweden story. The same dynamic has played out elsewhere: money supply growth falling below the Golden Growth Rate in the U.S. was flagged as a sign of tighter liquidity rather than any inflation comeback. In Switzerland, M3 money supply returning to an optimal growth range was cited as a setup consistent with low and stable prices.

⬤ What makes the Sweden reading notable right now is the timing. Markets are paying close attention to disinflation risks and how central banks might respond. If M3 growth stays stuck below the Golden Growth Rate level, price pressures will likely remain muted, keeping the policy conversation squarely on whether liquidity conditions are too tight relative to the inflation target. That same concern extends beyond Sweden, with slowing money supply growth raising deflation concerns in other major economies as well.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir