While most of the world struggles with inflation and volatile liquidity, Switzerland has quietly achieved the perfect balance. Inflation sits at just 0.1% year-over-year as of October 2025, while M3 money supply grew at 4.6% annually in August.

A Model of Monetary Precision

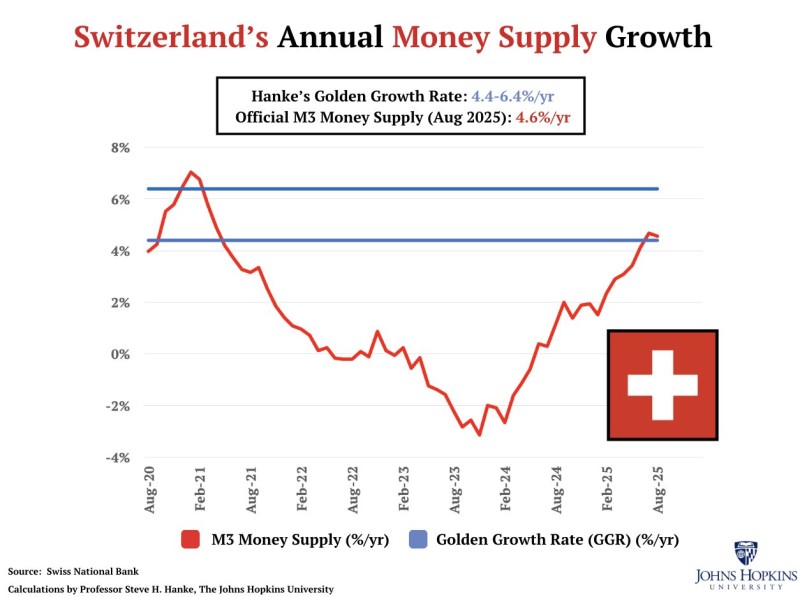

According to economist Steve Hanke's "Golden Growth Rate" framework of 4.4–6.4%, Switzerland's current trajectory sits right in the sweet spot. This shows that controlled money growth translates directly into low inflation without choking economic activity.

The chart from Johns Hopkins University shows Switzerland's full monetary cycle. In late 2020 and early 2021, M3 money supply jumped above 6% during the post-pandemic liquidity wave. As the Swiss National Bank (SNB) normalized policy, growth dropped to near 0% by early 2022 and turned negative in early 2023.

From there, a steady recovery began. By early 2024, money supply growth returned to positive territory and climbed into the 4–5% range. By August 2025, the M3 rate reached 4.6%, landing right in the optimal zone. Swiss liquidity conditions are perfectly balanced — neither too hot nor too cold.

The Economic Context

Switzerland's success comes down to discipline. After years of ultra-low rates and pandemic-era expansion, the SNB normalized policy without triggering deflation or credit problems. The Swiss franc remains strong, inflation sits at 0.1%, and moderate money supply growth supports real economic activity without eroding purchasing power.

This contrasts sharply with the Eurozone and U.S., where aggressive tightening followed years of excessive money printing. Switzerland proves that consistent monetary restraint preserves both growth and confidence.

Steady Growth, Lasting Stability

If the SNB maintains this balance, Switzerland could remain the global benchmark for monetary precision — delivering low inflation, a resilient currency, and sustainable growth. The latest data confirm a crucial truth: the inflation story is, at its core, a money supply story.

Peter Smith

Peter Smith

Peter Smith

Peter Smith