Everyone's been watching CPI numbers like hawks, terrified that inflation's about to come roaring back. But Johns Hopkins economist Steve Hanke says we're looking at the wrong data. Forget the monthly CPI drama - the real story is in M2 money supply growth. And that story suggests we've got bigger problems than runaway prices.

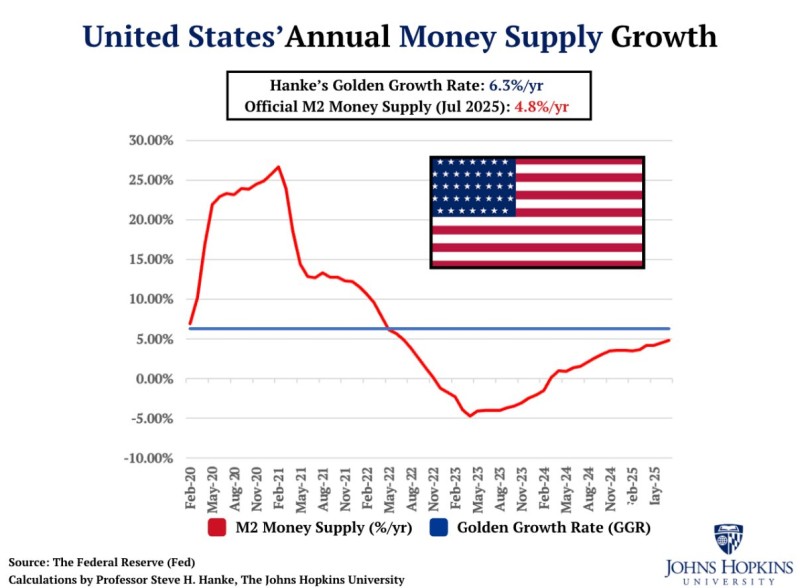

The latest numbers paint a picture that's completely different from what most people expect. US money supply is growing at just 4.8% annually, sitting well below Hanke's 6.3% "Golden Growth Rate" - the sweet spot he says delivers 2% inflation with steady growth.

Why This Changes Everything

Sure, headline CPI jumped to 2.9%, but Hanke argues that's just noise. The real signal comes from money supply, and as @amuse pointed out, inflation ultimately follows the money - not monthly CPI swings. With M2 growth this tight, the bigger risks are economic weakness and falling prices, not spiraling inflation.

This has huge implications across markets. Tight liquidity conditions could hammer corporate earnings and stock valuations. Bonds might actually do well if disinflation takes hold. And all those inflation hedges like commodities and crypto? They could seriously underperform unless the Fed starts expanding M2 again.

What the Charts Really Show

The Federal Reserve data tells a wild story. During the pandemic chaos of 2020-2021, M2 growth exploded past 25% year-over-year, which obviously fueled that brutal inflation spike we all lived through. Then came the crash - by 2022-2023, growth didn't just slow down, it went negative. That's almost unheard of in modern times.

Now we're at 4.8% as of July 2025, and that's the problem. This isn't the monetary backdrop for another inflation wave - it's setting us up for the opposite. When money supply runs this far below trend, you get weak demand, sluggish GDP growth, and disinflationary pressure instead of overheating.

Peter Smith

Peter Smith

Peter Smith

Peter Smith