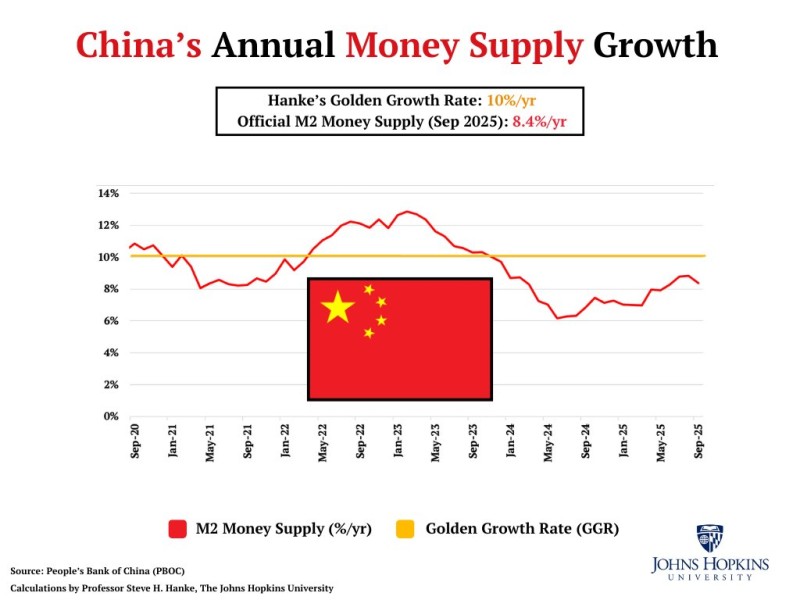

China's economy is flashing warning signs that can't be ignored. Annual M2 money supply growth dropped to 8.4% in September 2025, sliding beneath the critical 10% threshold. Meanwhile, consumer prices fell 0.3% year-over-year, confirming that deflationary pressures continue to grip the world's second-largest economy. These trends suggest China is struggling to generate the monetary momentum needed for healthy economic expansion.

Money Supply and Deflation Risks

Economist Steve Hanke has long argued that "the inflation story is a money supply story," and he defines 10% annual M2 growth as China's "Golden Growth Rate" - the level needed to maintain stable prices and sustainable expansion. Recent data tells a troubling story: after climbing above 12% in 2022–2023, China's money supply growth has steadily declined and now sits well below that benchmark.

This weakening expansion of M2 reflects tepid credit demand and limited effectiveness of stimulus measures, which together amplify deflationary risks. When money isn't flowing through the economy at a healthy pace, prices stagnate or fall, businesses hesitate to invest, and consumers delay spending - creating a self-reinforcing downward cycle.

Why This Is Happening

The People's Bank of China has adopted a cautious approach to monetary policy, attempting to strike a delicate balance between supporting growth and maintaining financial stability. This conservative stance stems largely from the country's mounting debt problems, particularly in the battered real estate sector and among heavily indebted local governments, which have constrained the central bank's ability to inject liquidity aggressively. Beyond domestic factors, China is also grappling with challenging external conditions including softer demand from trading partners, ongoing supply chain disruptions, and persistent trade tensions that continue to drag on growth momentum.

Implications for Markets and the Global Economy

The consequences of China's monetary slowdown extend far beyond its borders. For investors, sluggish money supply growth serves as a bearish indicator for Chinese equities, suggesting corporate earnings and economic activity will remain under pressure. The commodities sector faces particular vulnerability since China's massive appetite for raw materials has been a key driver of global prices - any sustained weakness in Chinese demand could soften commodity markets worldwide. Emerging markets throughout Asia and beyond should also watch carefully, as prolonged deflation in China threatens to reduce trade flows, dampen investment activity, and weaken growth prospects across interconnected economies.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov