November has always been a reliable month for stock market gains, but 2025 is proving to be a striking exception. The S&P 500 is currently tracking one of its weakest November returns in over 15 years, raising questions about market momentum heading into year-end.

S&P 500 Struggles Through Historically Strong Month

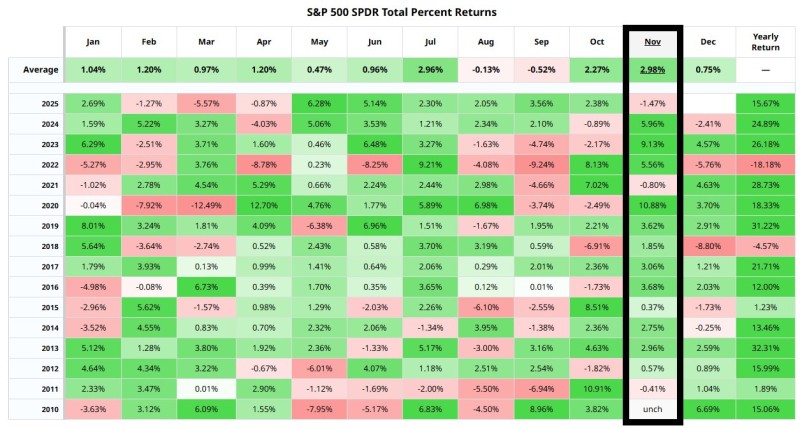

In what's usually one of the market's best months, the S&P 500 is instead posting a rare November decline. Recent monthly return data shows the index is currently in negative territory, a sharp contrast to November's long-term average of +2.98%. This downturn stands out even more when you look at recent history—November delivered gains in nearly every year over the past decade and a half, including exceptional performances like +10.88% in 2020 and +9.13% in 2023.

The weakness this year is particularly unusual given how strong the market was earlier in 2025. May brought +6.28% gains and June added another +5.14%, but momentum clearly faded as the year progressed. The current November decline suggests investors are dealing with a mix of concerns: stretched valuations after the summer rally, lingering worries about interest rates, and broader macroeconomic uncertainty that's finally catching up with the market.

What makes this even more significant is November's historical role as a setup month for December. When November stumbles, it often dampens the traditional year-end rally as institutional investors shift toward protecting capital rather than chasing returns. The pattern we're seeing now—strong early-year gains followed by late-year weakness—typically signals deeper concerns about earnings momentum and market fundamentals.

Key Factors Behind the Weakness:

- Macroeconomic uncertainty weighing on investor sentiment despite earlier optimism

- Valuations stretched from summer rally creating natural resistance to further gains

- Interest rate concerns resurfacing as inflation dynamics remain uncertain

- Geopolitical tensions adding volatility and reducing risk appetite

- Seasonal strength failing to materialize raises questions about December positioning

Looking Ahead

As we move into the final weeks of the year, the real question is whether this November weakness carries over or if the market can recover some of its typical seasonal strength in December. The breakdown of November's usually reliable pattern serves as a warning sign that something has shifted in market dynamics. Traders and investors will need to watch closely whether institutional money returns or if the cautious positioning continues through year-end.

For now, the S&P 500's struggle through what should be a favorable month stands as one of the year's most notable divergences from historical norms.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov