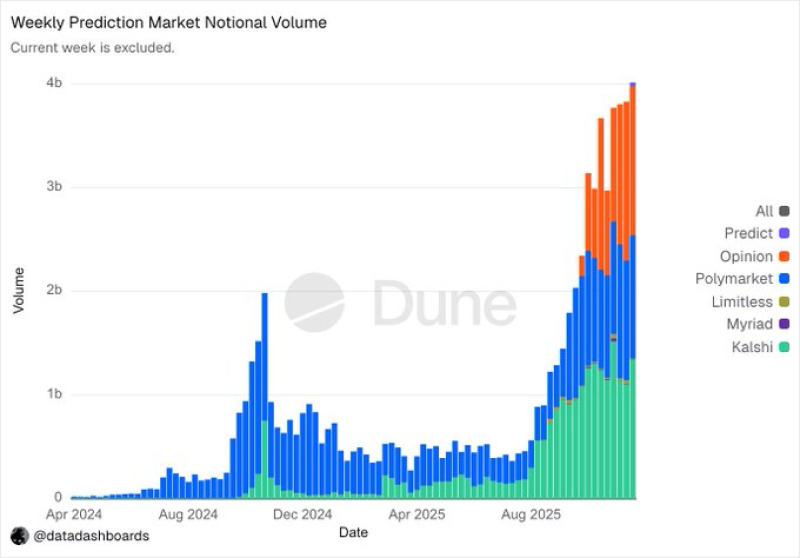

⬤ Prediction markets just hit a massive milestone—over $4 billion in weekly trading volume for the first time. The sector's been on a tear through 2024 and into 2025, and the latest numbers show participation and liquidity ramping up fast. Charts tracking the growth reveal a sharp climb, with the most recent week setting a new all-time high.

⬤ Last week alone saw more than 13 million transactions go through prediction market platforms. Around 285,000 active users were trading during that period, showing the space is pulling in more people. Total open interest—basically the money locked into active bets—reached roughly $700 million. That's a lot of capital sitting on the table, and it points to serious engagement from traders who are willing to put real money behind their forecasts.

⬤ Prediction markets work like exchanges where people bet on real-world events, and prices shift based on what traders think will actually happen. The jump in volume isn't coming from just one platform either—multiple venues are contributing, which means the growth is happening industry-wide. That's a healthier sign than if everything was concentrated in one place.

⬤ More liquidity and more participants mean better price discovery. When you've got $4 billion moving through the system weekly, millions of transactions, and hundreds of thousands of users actively trading, these platforms become genuinely useful tools for reading the room on politics, economics, and major financial events. It's not just speculation anymore—it's turning into a real barometer for what people expect to happen next.

Usman Salis

Usman Salis

Usman Salis

Usman Salis