After experiencing sustained cooling in price pressures throughout 2025, India has recorded its first meaningful inflation rebound. The latest consumer price index data reveals that while inflation remains well-controlled, the downward trend that dominated recent months may be reaching its natural floor. This development carries important implications for monetary policy and economic outlook as the country navigates evolving price dynamics.

Recent Inflation Patterns

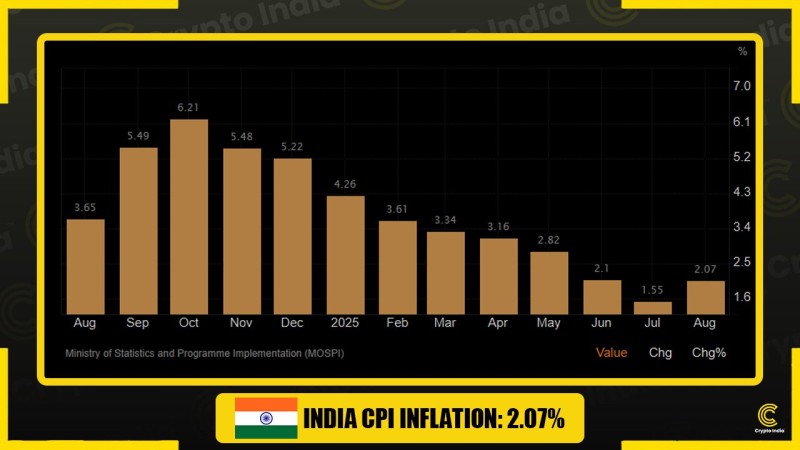

The CPI data reveals a distinct three-phase pattern over the past year. Inflation peaked at 6.21% in October 2024, representing the highest level in over a year before entering a sustained decline phase. From November 2024 through July 2025, prices consistently eased month after month, ultimately reaching a cycle low of 1.55% in July. As noted by trader Crypto India, August's reading of 2.07% breaks this downward streak, suggesting the cooling phase may have run its course.

Together, these factors highlight that August's rise is more a reflection of short-term fluctuations than a sustained shift in inflationary dynamics.

Key Contributing Factors

The August uptick stems from multiple converging influences on the price landscape. Food prices have experienced seasonal increases, particularly in vegetables and grains, creating upward momentum in the overall index. Energy costs have also played a role, with fuel price adjustments adding modest inflationary pressure. Additionally, the base effect from July's unusually low 1.55% reading amplifies the apparent magnitude of August's increase, making the month-over-month change appear more pronounced than underlying trends might suggest.

Policy and Market Implications

With inflation remaining comfortably below the Reserve Bank of India's 6% upper tolerance limit, monetary policymakers retain considerable flexibility in their approach. The central bank is unlikely to pursue aggressive rate increases based on this single data point, but the reversal does indicate that inflationary risks require continued monitoring. Financial markets may view this development as evidence of macroeconomic stability rather than cause for concern, while bond yields are expected to remain relatively steady unless additional inflation surprises emerge in coming months.

Peter Smith

Peter Smith

Peter Smith

Peter Smith