The Nasdaq has always served as the market's pulse for innovation and speculation. From the internet frenzy of the late 1990s to today's AI-driven enthusiasm, its valuations reveal compelling insights about investor psychology. As the index climbs once more, a critical question emerges: are we approaching another bubble-like surge, or do current conditions differ fundamentally from the past?

Lessons From the Dot-Com Era

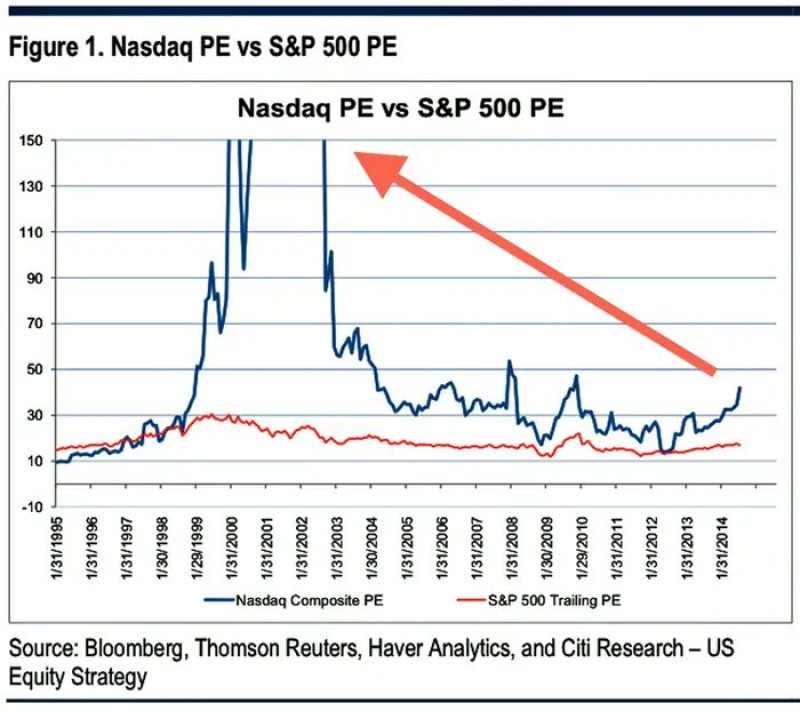

The late 1990s witnessed one of history's most dramatic valuation expansions. Between 1998 and 2000, the Nasdaq Composite's price-to-earnings ratio exploded from around 30 to nearly 200 in just two years. This meteoric rise, driven by internet euphoria, culminated in a devastating crash that wiped out trillions in market value.

Today's landscape tells a different story. As analyst Zafar Shaikh notes, the Nasdaq 100 currently trades near a considerably more modest PE of approximately 32.

While elevated by historical standards, this figure appears reasonable when compared to the extreme valuations of the dot-com peak.

The contrast becomes even starker when examining how the Nasdaq PE diverged so dramatically from the S&P 500 PE during the bubble years, highlighting the speculative mania that gripped technology stocks at the time.

Long-Term Technical Perspective

Taking a broader view through an inflation-adjusted lens reveals interesting structural patterns. Since the 1970s, the Nasdaq has operated within a rising channel that has contained major cycles including the 1980s boom, the dot-com bubble, and the post-2008 recovery. Currently, the index finds itself testing the upper boundary of this channel once again, a technical zone where previous rallies have historically encountered resistance or reversal points.

This positioning suggests that while valuations haven't reached dot-com extremes, the market may be entering a late-cycle phase structurally. Another strong upward move remains possible and could manifest as a climactic surge before an inevitable cooling-off period, following the historical pattern of channel behavior.

Current Market Dynamics

Unlike the dot-com era's speculative foundation, today's growth drivers rest on more tangible fundamentals: artificial intelligence advancement, robust cloud infrastructure development, and widespread digital transformation across industries. These represent genuine technological shifts with measurable business impact, contrasting sharply with the often theoretical internet promises of 1999.

However, investor psychology remains remarkably consistent across decades. Excitement tends to build as markets approach technical resistance levels, often followed by periods of increased volatility. Understanding this cyclical nature of market sentiment provides valuable context for navigating current conditions and preparing for potential shifts ahead.

Peter Smith

Peter Smith

Peter Smith

Peter Smith