That is how Security Matters PLC (NASDAQ: SMX) should be viewed in the context of its November move to roughly $490 per share. That level did not emerge from incremental news flow or quarter-to-quarter execution. It reflected a short window where investors began to connect SMX’s positioning across multiple supply chains and price it accordingly.

The more relevant question now is not how the stock reached $490, but whether the underlying reasons for that recognition have strengthened since. And at its current $145, does it present an opportunity too attractive to ignore.

Markets Don’t Reprice Products, They Reprice Control Points

Perhaps, especially because SMX is disrupting markets rather than simply engaging them. Most technologies compete on features. SMX competes on placement. Its molecular-level marker is not layered on top of processes. It is embedded at the beginning of them, at the point where materials first acquire economic identity.

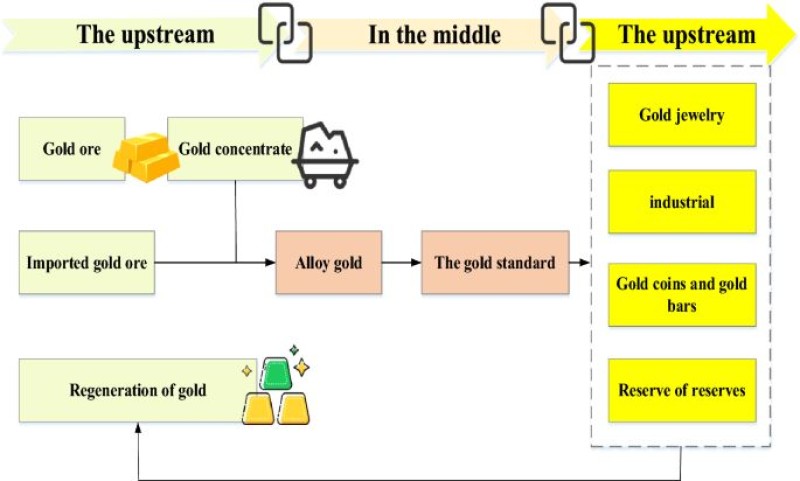

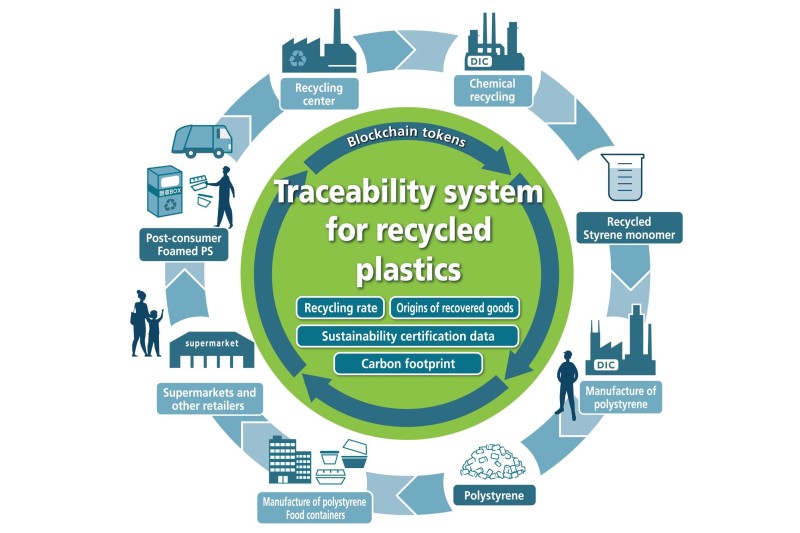

Ore before refining. Polymer feedstock before molding. Rubber before processing. Components before assembly.

This matters because markets ultimately assign premiums to control points, not endpoints. When identity is introduced late, it is fragile. Documentation can be disputed. Certifications can be gamed. Audits can only approximate truth. When identity is embedded at origin, it becomes persistent. Every downstream step inherits that certainty without needing to recreate it.

That upstream positioning is why SMX is increasingly better understood as infrastructure rather than a compliance solution. Infrastructure is rarely valued correctly early. It is repriced once reliance becomes visible.

Gold, Plastics, Rubber, and Hardware Are Not Separate Stories

One reason SMX is often misunderstood is that its exposure spans markets that investors typically evaluate in isolation. Gold is treated as a provenance problem. Plastics as a sustainability problem. Rubber as a sourcing problem. Hardware as a security problem.

In reality, they all share the same structural flaw: identity breaks as materials move.

Gold highlights the importance of origin. Provenance is inseparable from value, and tolerance for error is minimal. SMX’s ability to embed identity at the earliest stages of the gold lifecycle demonstrates that the technology can function in the most conservative and unforgiving environment imaginable.

Plastics and rubber introduce scale. High volume, complex processing, and regulatory pressure create conditions where documentation fails by default. SMX’s early touchpoint at feedstock and processing prevents identity from fracturing before scale begins, allowing verification to persist without reconstruction.

Hardware and industrial components elevate the discussion to risk. Counterfeit and compromised parts enter the supply chain upstream, long before final assembly. Embedding identity at the material and component stage turns downstream inspections into confirmations rather than investigations.

These are not separate use cases. They are expressions of the same system operating under different economic pressures. That unification is what platforms look like before the market agrees to call them platforms.

Why $490 Was About Recognition, Not Completion

SMX’s November move to approximately $490 per share occurred during a period of heightened attention, when investors briefly priced the company less as a single-market technology and more as a cross-supply-chain control layer. That move did not require full market penetration, nor did it depend on long-term financial modeling. It depended on recognition.

Recognition that SMX sits upstream. Recognition that identity embedded at origin has compounding value. Recognition that partnerships placing the technology earlier in multiple lifecycles create leverage that is difficult to replicate.

From that perspective, the question is not whether Security Matters PLC can reclaim $490, but whether the market has fully absorbed what it is pricing when it does. At recent levels near $145, recognition appears partial. At $300, the valuation begins to reflect SMX’s role as an upstream control point rather than a single-market technology. A return toward prior highs would imply broader understanding, and recent partnership momentum suggests that understanding is forming faster than many expect.

History suggests that infrastructure stories are rarely repriced gradually. They move in steps, often overshooting before settling, as markets recalibrate where value actually resides.

SMX’s November high may not represent an endpoint. It may represent the first time the market briefly saw the whole picture.

And when markets learn to see control points clearly, they tend not to forget them.

Disclaimer

This article is a third-party editorial and is provided for informational purposes only. It does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed are those of the author and do not necessarily reflect the views of any company mentioned. Security Matters PLC (NASDAQ: SMX) is referenced for illustrative and informational purposes only.

Readers should conduct their own independent research and consult with a qualified financial adviser, broker, or professional before making any investment decisions. Investing in publicly traded securities involves risk, including the possible loss of principal. Past performance and historical trading behavior are not indicative of future results.

Neither the author nor the publisher is a registered investment adviser, and no representation is made regarding the accuracy or completeness of the information contained herein.

Editorial staff

Editorial staff

Editorial staff

Editorial staff