Solana has caught traders' attention with fresh bullish signals appearing on its charts. The cryptocurrency is now testing a crucial support level that could determine its next major move. With technical indicators aligning and broader market conditions improving, SOL finds itself at a pivotal moment.

Technical Setup Points to Potential Rally

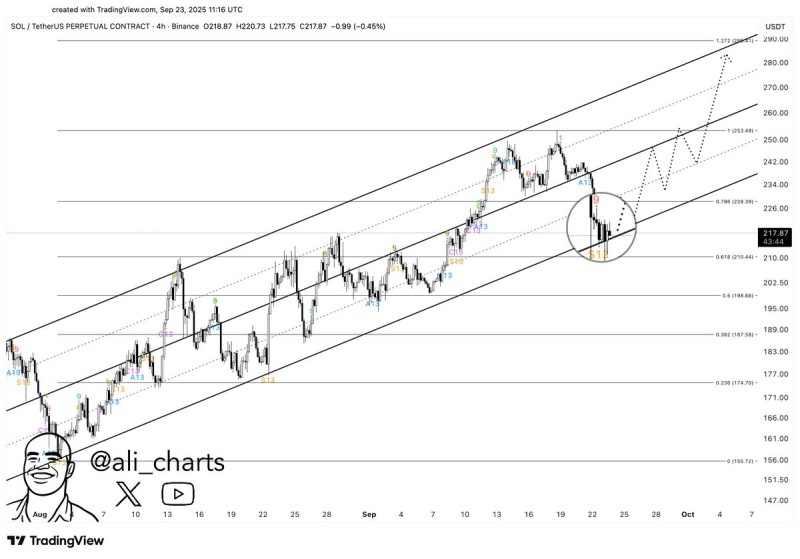

As noted by analyst Ali, Solana's 4-hour chart shows a TD Sequential double buy signal right as the price approaches the key $210 support zone. This timing makes the current price action particularly significant for determining the next direction.

The rising channel that has contained SOL's price action since early August remains intact. Within this structure, the TD Sequential has printed both "9" and "13" counts in oversold territory, typically signaling trend exhaustion and potential reversal. The $210 level gains additional importance as it coincides with the 0.618 Fibonacci retracement, creating a confluence of technical support.

Should buyers successfully defend this area, immediate upside targets include $228 resistance, followed by the more significant $250 level. A breakout above $250 could extend the rally toward $263 and eventually the $280-$290 Fibonacci extension zone.

Fundamental Factors Support Technical Picture

Beyond the chart patterns, several fundamental elements work in Solana's favor. The network maintains its position as one of the most active Layer-1 ecosystems, hosting significant DeFi, NFT, and payment applications. Institutional interest continues growing, with SOL appearing more frequently in crypto investment products and research reports. The broader altcoin recovery trend has also positioned Solana as a potential leader in any sustained rally.

Critical Juncture at $210

The immediate focus centers on how SOL responds to the $210 support test. A successful defense could quickly propel the price back toward $250, with further upside potential to $263-$280. However, a breakdown below $210 would compromise the bullish setup and expose downside risk toward $198 or $187.

Current momentum appears to favor the bulls, but the support test will ultimately determine whether the next leg higher can commence.

Usman Salis

Usman Salis

Usman Salis

Usman Salis