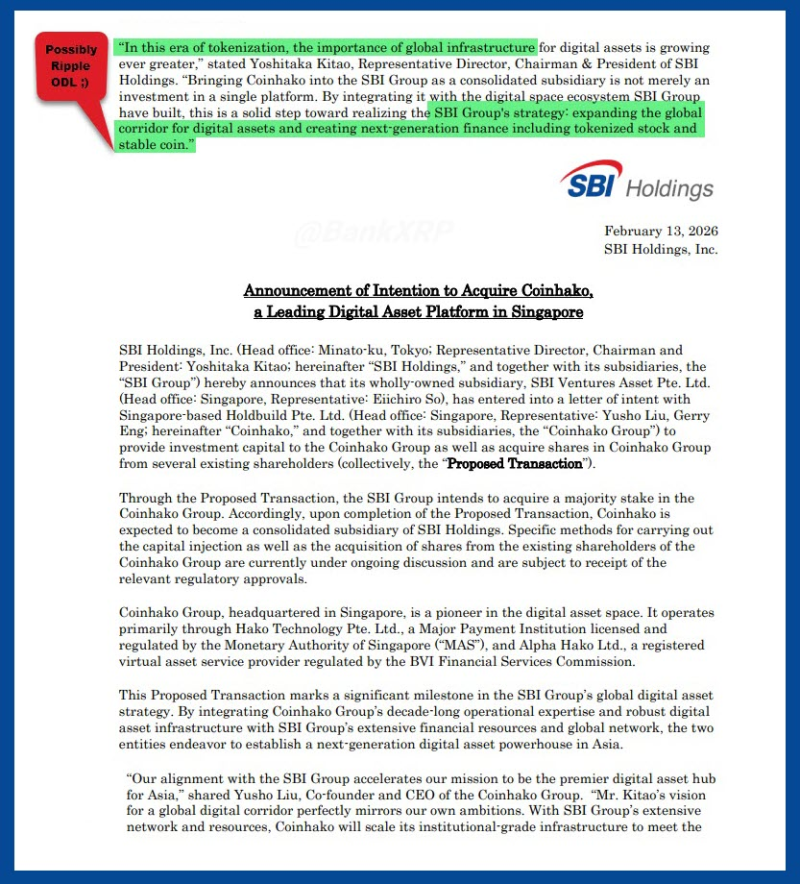

⬤ SBI Holdings has revealed its intention to acquire a controlling stake in Coinhako, a regulated digital asset platform based in Singapore. The Japanese financial group is targeting a majority ownership structure that would turn Coinhako into a consolidated subsidiary. SBI is framing this acquisition as a critical step in building what it calls a "global corridor for digital assets" and advancing tokenization-based financial services throughout the region.

⬤ The proposed deal involves a combination of fresh capital injection into the Coinhako Group and the purchase of shares from current stakeholders. The transaction still needs regulatory approvals before it can close. Coinhako operates under a strict regulatory framework—it holds a Major Payment Institution license from the Monetary Authority of Singapore and is registered as a virtual asset service provider with the BVI Financial Services Commission.

⬤ SBI is positioning this move within what it describes as the "era of tokenization." The company emphasized the growing need for robust global infrastructure to support digital assets, including tokenized securities and stablecoins. Once integrated, Coinhako would become part of the larger SBI Group ecosystem, with the stated goal of scaling institutional-grade digital asset services across Asian markets.

⬤ This development highlights how major financial institutions are strategically expanding their footprint in regulated crypto platforms through cross-border acquisitions. As tokenization and stablecoin adoption edge closer to traditional financial systems, deals like this could significantly speed up the development of compliant market infrastructure in key Asian financial centers.

For context, SBI has been deepening its crypto involvement. The firm previously announced a partnership to launch RLUSD stablecoin in Japan, and SBI VC Trade became a validator on the XRP Ledger, reinforcing its commitment to the XRP ecosystem and broader digital asset infrastructure.

Peter Smith

Peter Smith

Peter Smith

Peter Smith