Japan has emerged as one of the world's most crypto-friendly nations, with clear regulations and major financial institutions actively embracing digital assets. Now, Ripple is positioning itself to capitalize on this favorable environment with a strategic move that could reshape the country's stablecoin landscape.

The partnership between Ripple and SBI Holdings represents more than just another crypto announcement—it's a calculated play to establish XRP as a cornerstone of Japan's digital payments infrastructure. With the $RLUSD stablecoin set to launch in Q1 2026, this collaboration could trigger significant changes for both the Japanese market and XRP's global trajectory.

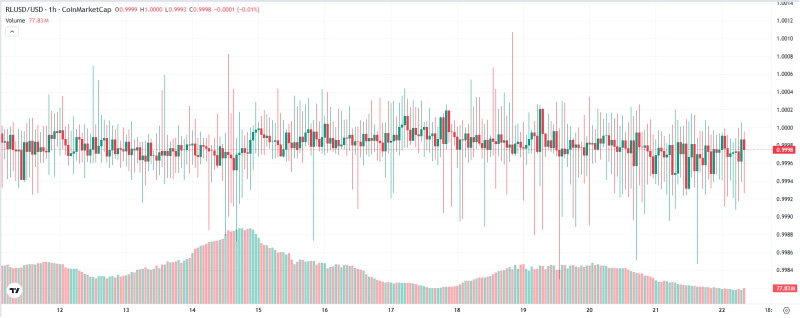

Ripple (XRP) Price Reacts to SBI Partnership News

Ripple just dropped major news that has the crypto community buzzing. The company announced it's teaming up with SBI Holdings—one of Japan's financial heavyweights—to bring the $RLUSD stablecoin to Japanese markets starting in Q1 2026.

This isn't some random partnership announcement. SBI Holdings has been backing Ripple for years, and they've been quietly building toward this moment. The plan is simple but powerful: use Ripple's XRP Ledger to create a smoother digital payments system across Japan. Every transaction burns a tiny bit of XRP, which could gradually push prices higher as usage grows.

The timing couldn't be better. Japan's regulatory environment is welcoming crypto innovation while other countries are still figuring out their approach.

$RLUSD Stablecoin: A Catalyst for XRP Price Growth

Here's what makes this announcement different from typical crypto partnerships: $RLUSD isn't just another stablecoin. It's being launched in one of the world's most regulated and sophisticated financial markets, targeting both everyday users and big institutions.

For XRP holders, this translates to something they've been waiting for—real utility. More $RLUSD transactions mean more activity on the XRP Ledger, which means more XRP getting burned with each transaction. It's basic economics: reduce supply while increasing demand, and prices typically follow suit.

Analysts are already calling this Ripple's biggest strategic move in Asia. The company is positioning XRP as the go-to bridge currency for digital payments in a region that's rapidly going cashless.

Market Reaction and Bullish Sentiment on XRP Price

The crypto crowd wasted no time reacting to this news. Social media lit up with bullish predictions and rocket emojis as traders started connecting the dots between Japan's massive financial market and XRP's potential growth.

What's interesting is the pattern here. Ripple's previous partnerships with major financial players have historically coincided with significant price jumps. The SBI deal might be setting up for something similar, especially with nearly two years to build anticipation before the 2026 launch.

Smart money is already eyeing key resistance levels, expecting increased buying pressure as the launch date approaches.

Usman Salis

Usman Salis

Usman Salis

Usman Salis