⬤ Oil market positioning took a sharp turn upward as speculative interest grew across major petroleum contracts. Hedge funds and other money managers bought the equivalent of 15 million barrels of futures and options across six key petroleum contracts during the week ending February 10, according to John Kemp.

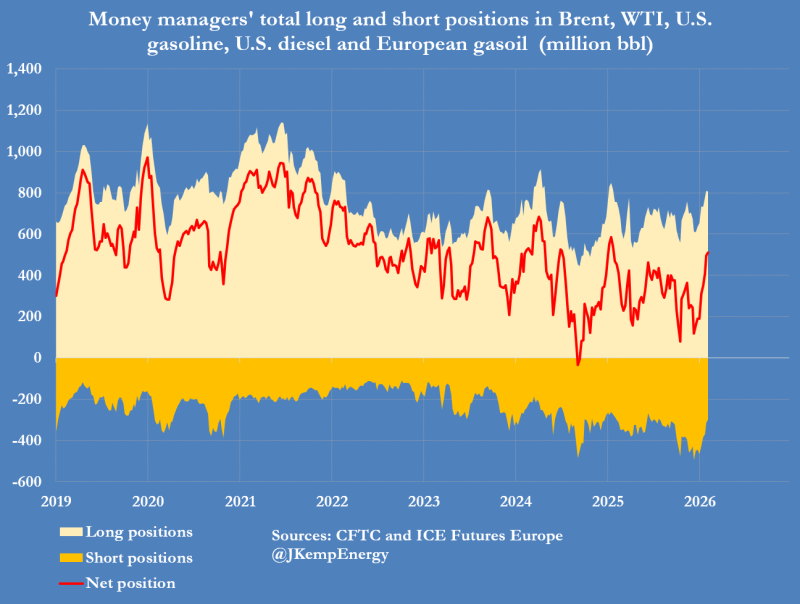

⬤ The bigger picture reveals sustained accumulation over recent weeks. Fund managers have been buying petroleum in seven of the last eight weeks, piling up a total of 391 million barrels since mid-December. Their combined position climbed to 509 million barrels from roughly 117 million barrels eight weeks earlier—a significant move from near-record lows toward the middle of the historical range.

⬤ The data tracks positioning across Brent, WTI, U.S. gasoline, U.S. diesel, and European gasoil. Long positions consistently outweigh short positions while the net position line trends higher within its historical band. As one analyst noted, "The shift coincides with increasing attention to geopolitical supply risks," particularly concerns around Iran-China supply dynamics that could disrupt global flows.

⬤ This positioning shift shows how traders adjust their bets when they sense supply disruptions looming. The rising net long exposure reflects changing sentiment across the petroleum complex and underscores how geopolitical developments drive participation in energy futures markets. The turnaround follows a five-month price slide that reversed in January, when oil prices jumped 4.6% as traders began pricing in tighter supply scenarios.

⬤ The move from bearish to cautiously bullish positioning marks a notable sentiment shift in energy markets. With funds now holding their largest net long position in months, the market appears increasingly focused on supply-side risks rather than demand concerns that dominated the previous selloff.

Peter Smith

Peter Smith

Peter Smith

Peter Smith