The global oil market faces fresh uncertainty as the United States considers tightening the screws on Iranian crude shipments. With approximately 1.5 million barrels per day flowing primarily to China, any enforcement escalation could reshape supply dynamics and trigger price volatility across WTI and Brent benchmarks.

US Enforcement Threatens Iran's 1.5M Barrel Daily Flow

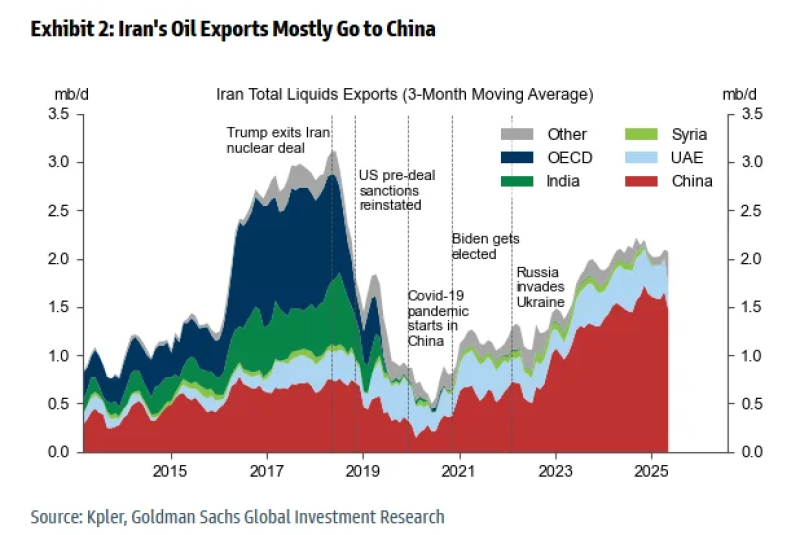

The United States is exploring stronger enforcement measures to choke off Iranian oil shipments, particularly those headed to China. Iran currently exports around 1.5 million barrels per day, with Chinese refiners serving as the primary buyers. Recent data shows China has consistently dominated Iranian crude purchases over the past several years, creating a critical supply link between Tehran and Beijing.

This isn't Washington's first rodeo with Iranian oil sanctions. When the U.S. pulled out of the Iran nuclear deal in 2018, exports plummeted as sanctions bit hard. Volumes partially bounced back through shadowy shipping networks and creative logistics, then dipped again during the Covid-19 crisis before climbing after 2022 as global trade patterns evolved.

How Tighter Sanctions Could Reshape Global Crude Markets

The real question now is enforcement risk. If Washington cranks up the pressure, some Iranian barrels could vanish from transparent markets, forcing refiners to scramble for replacement supplies. That would tighten heavy crude availability and likely push prices upward.

History shows that geopolitical supply risks tend to spike oil markets when sanctioned exports become harder to transport or insure. Similar dynamics have previously elevated both WTI and Brent pricing when trade routes get disrupted.

China's response will be critical. Beijing has already shown flexibility in its crude sourcing strategy, as evidenced by recent pivots to Canadian crude to offset potential shortfalls.

Market Impact: Supply Perception vs. Reality

What makes this situation particularly interesting is that US sanctions impact oil supply perception as much as actual production. Even without immediate cuts to Iranian output, tougher enforcement changes shipping routes, increases transportation risk, and widens pricing spreads.

The bottom line? Traders should watch for two things: official policy announcements from Washington and any signs of Chinese refiners adjusting their purchasing patterns. Both could signal whether this enforcement talk turns into real market disruption or remains just another round of geopolitical posturing.

For now, the 1.5 million barrel question hangs over the market – will these barrels stay visible, or will they disappear into the shadows?

Usman Salis

Usman Salis

Usman Salis

Usman Salis