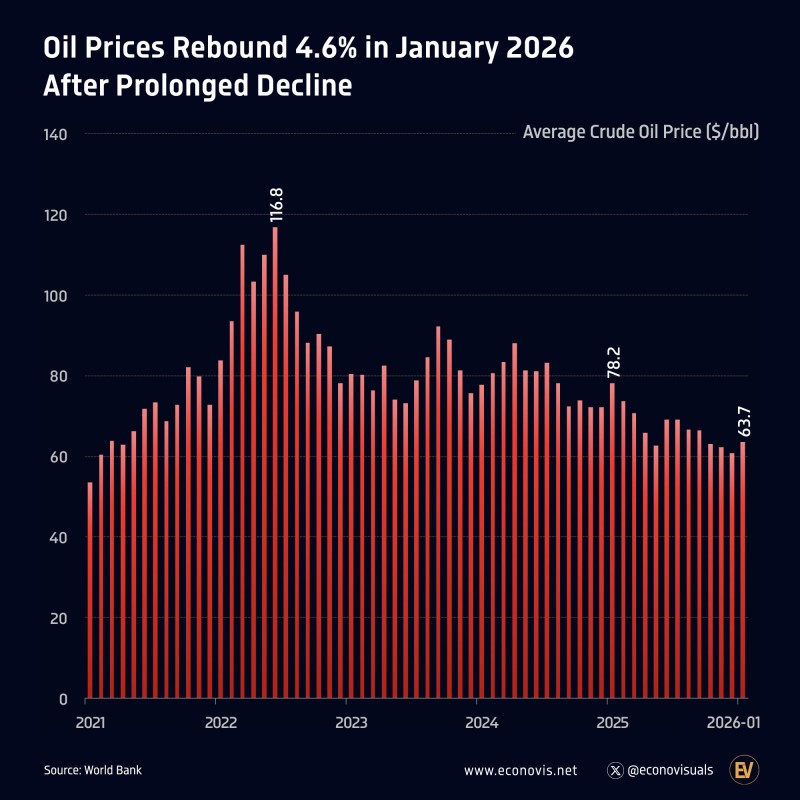

After months of steady declines, the global oil market showed signs of life in January 2026. Major crude benchmarks including WTI, Brent, and Dubai all posted gains, marking the first upward movement in half a year. While the increase offers a glimpse of potential stabilization, prices remain significantly below last year's levels, leaving traders and analysts watching closely for what comes next.

Oil Prices Rise $2.80 to Reach $63.70 Per Barrel

Global crude oil benchmarks finally caught a break at the start of 2026 after a prolonged slump. Average prices across rose 4.6 percent in January, climbing about $2.80 to hit $63.70 per barrel. The move marked the first monthly increase since mid-2025, breaking a five-month losing streak that had pushed prices steadily lower.

Looking back at recent history, the chart data tells a dramatic story. Oil prices spiked above $110 during 2022 before trending downward throughout 2023 and 2024. The weakness carried into 2025, with the market gradually sliding toward the low $60 range. January's rebound interrupted that decline, but it didn't reverse the broader trend. In fact, prices still sat 18.6 percent lower compared to the same month a year earlier.

Coordinated Price Movement Across Global Benchmarks

What made this recovery particularly noteworthy was its breadth. The increase wasn't limited to one regional contract—WTI, Brent, and Dubai all reflected the same monthly rise, pointing to a coordinated shift in market dynamics rather than isolated regional factors.

"The January rebound interrupted the decline but did not reverse the longer trend," according to the market data.

Despite the improvement, current pricing remains much closer to recent lows than to previous cycle highs. Energy traders following related developments might recall similar shifts discussed in Brent oil dips in Asia trading.

What This Oil Price Stabilization Means for Energy Markets

This development carries weight because monthly oil price changes often signal turning points in commodity cycles. The break in the five-month decline suggests the energy market may be finding its footing, though the continued year-over-year drop shows pricing conditions remain considerably weaker than previous peaks. Whether January's gain represents a genuine floor or just a temporary pause in a longer downtrend remains the key question for the months ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis