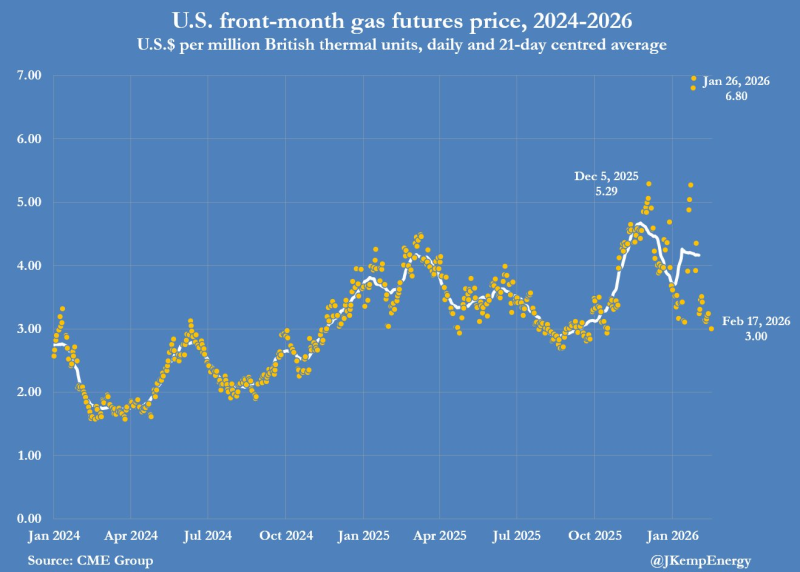

The natural gas market just delivered one of its most dramatic reversals in recent memory. After Winter Storm Fern pushed front-month futures to $6.80 per million British thermal units in late January, prices have since cratered back to the $3 threshold by mid-February. This rapid 56% decline underscores the extreme volatility that continues to define the NG natural gas futures market, leaving traders and analysts reassessing where prices go from here.

Winter Storm Fern Spike Completely Erased

NG natural gas futures have pulled back to around $3 per MMBtu, marking the lowest level since mid-October and the weakest reading in almost four months. The retreat follows a sharp spike linked to Winter Storm Fern, with front-month prices reversing nearly all of the late-January surge that briefly energized bullish sentiment across energy markets.

The price trajectory tells the story. Front-month pricing reached $6.80 on January 26, 2026, then fell rapidly toward $3.00 by February 17, 2026. An earlier peak of $5.29 on December 5, 2025, shows just how quickly Natural Gas Jumps 12% in Its Biggest Rally Since May can transform into sudden weakness within weeks.

Inflation-Adjusted Prices Hit 25th Percentile Since 2010

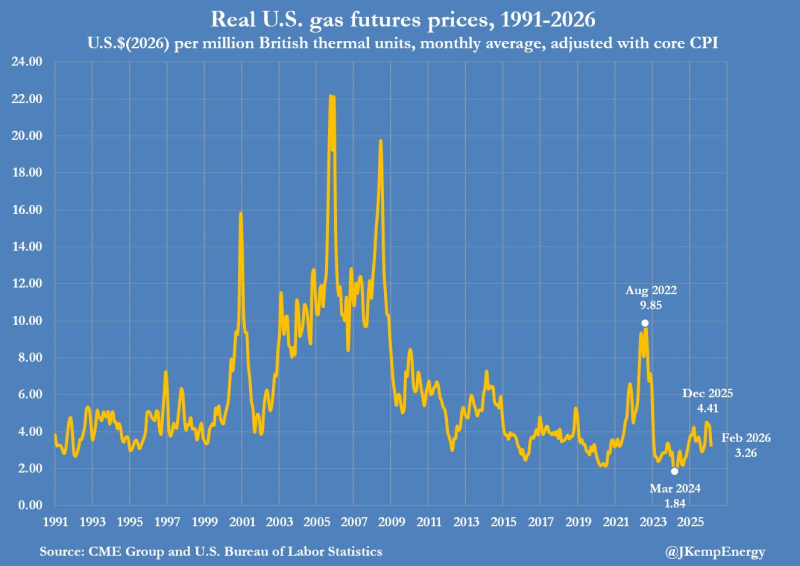

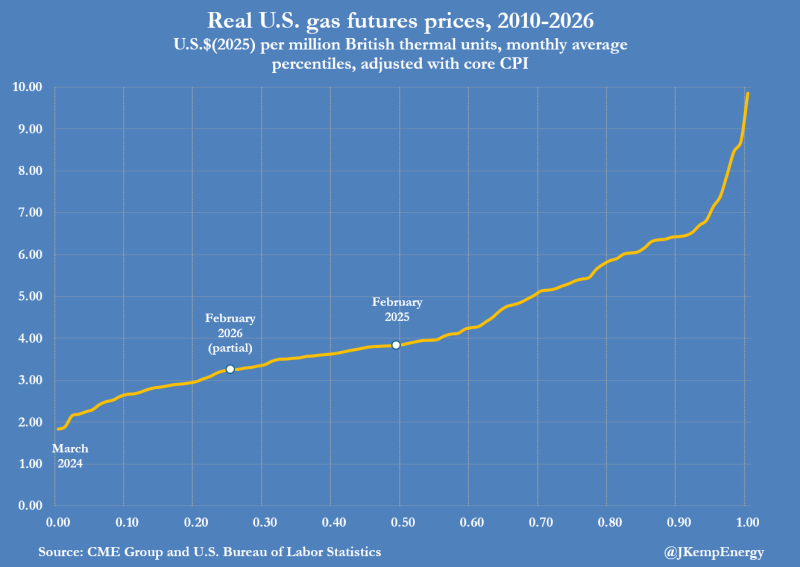

Monthly data reveals just how soft current conditions have become. The front month averaged $3.26 through mid-February, representing the lowest monthly average since September. After adjusting for inflation, the average price sits in only the 25th percentile since 2010, down sharply from the 49th percentile during the same month a year ago.

This inflation-adjusted context matters. While Natural Gas Tests $3 Support After 8% Drop episodes grab headlines, the longer-term picture shows real U.S. gas pricing remains subdued relative to many historical periods despite episodic weather-driven spikes.

What the Post-Storm Reset Means for Traders

The latest retreat frames the post-storm reset in NG natural gas futures against both short-term momentum and inflation-adjusted benchmarks. With front-month pricing back near $3 and real-price positioning in a lower historical percentile band, the market narrative has shifted decisively from the storm-driven surge to questions about fundamental supply-demand balance.

Traders watching Natural Gas Drops Below $4 as Market Tests $3 Support Zone will be focused on whether the $3 level holds or if further downside emerges as winter demand fades and storage dynamics come back into focus.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah