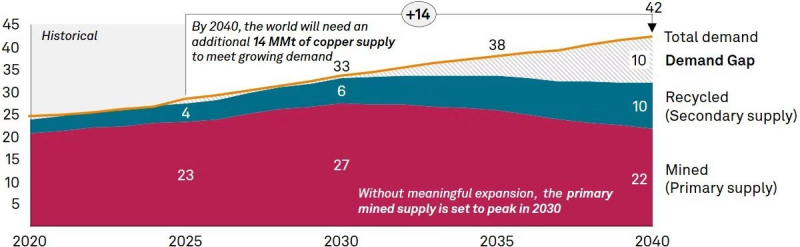

⬤ Copper is staring down a supply crisis that's been years in the making. Global copper demand could require an additional 14 million metric tons annually by 2040—about 50% more than current production levels. The analysis warns of a potential shortage approaching 10 million tons, describing the scenario as a looming "copper apocalypse."

⬤ The numbers paint a stark picture. Demand is expected to climb to around 42 million tons by 2040, but mined copper supply looks set to peak around 2030 before declining to roughly 22 million tons a decade later. Recycled copper might add another 10 million tons, but that still leaves a gap of approximately 10 million tons unfilled. This isn't a short-term squeeze—it's a structural mismatch between what the world needs and what miners can deliver.

⬤ The challenge goes beyond simply opening new mines. Filling a 10-million-ton gap would require bringing online the equivalent of several world-class copper projects in relatively short order, and the industry hasn't shown it can move that fast. Even with recycling ramping up, primary supply is projected to fall while demand keeps climbing, driven largely by electrification and the energy transition.

⬤ For markets, this matters because it signals a multi-year period where global copper demand set to jump 50% by 2040 as supply falls short. The U.S. builds largest copper stockpile in decades as 15 million tonne deficit looms by 2040, positioning strategically ahead of the crunch. Meanwhile, copper and lithium demand set to double by 2040 as energy transition accelerates, putting pressure on prices and prompting investors to reconsider how scarcity gets priced in over time.

Usman Salis

Usman Salis

Usman Salis

Usman Salis