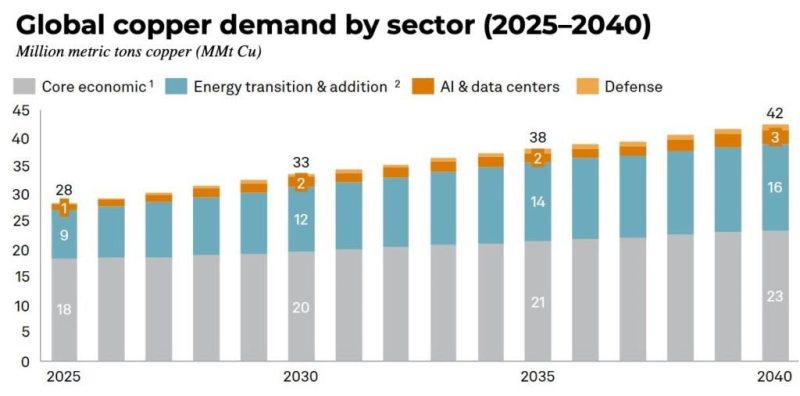

⬤ Global copper consumption is heading for significant growth over the next 15 years, with demand expected to jump from around 28 million metric tons in 2025 to roughly 42 million metric tons by 2040. That's a 50% increase driven by everything from traditional infrastructure to the clean energy buildout happening worldwide.

⬤ The demand story breaks down into a few key areas. Core economic uses—think construction, manufacturing, and traditional infrastructure—will grow from about 18 million metric tons to 23 million metric tons by 2040. But the real action is in energy transition and grid infrastructure, which is projected to nearly double from 9 million metric tons to 16 million metric tons. Smaller but growing sectors like AI data centers and defense applications are adding to the mix as electrification spreads across the economy.

⬤ Here's where things get interesting: while demand keeps climbing, copper supply is expected to peak around 33 million metric tons near 2030, then drop off sharply—potentially falling below 19 million metric tons by 2035. That creates a widening gap between what the world needs and what mines can produce, with the mismatch getting worse as the decade progresses.

⬤ This supply-demand imbalance isn't just a theoretical problem. Copper is essential for power grids, electric vehicles, renewable energy systems, and digital infrastructure. Unless alternatives like aluminum can scale up quickly enough to fill the gap, the copper market could face serious tightness in the late 2030s. With most of the demand growth tied to long-term structural shifts rather than cyclical swings, this supply crunch is likely to be a defining feature of the metals market for years to come.

Peter Smith

Peter Smith

Peter Smith

Peter Smith