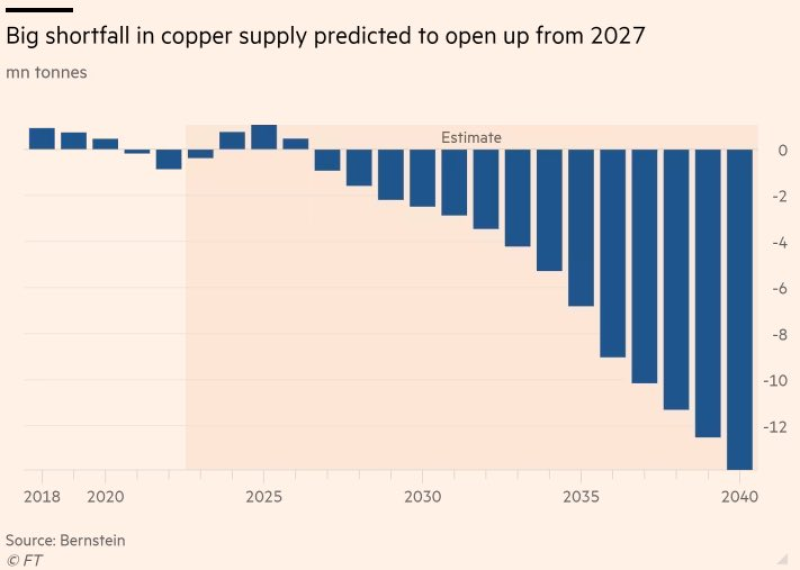

The copper market is heading toward a structural crisis that could reshape global supply chains for decades. While current inventories appear stable, long-range projections reveal a widening gap between demand and production that begins in 2027 and accelerates dramatically through the 2040s. The U.S. response? Building its largest copper stockpile in generations.

Copper Deficit Timeline: From Surplus to 15 Million Tonne Shortfall

Smart money is already positioning for what's coming. According to Oguz Erkan, the United States has quietly assembled its biggest copper inventory in decades, and the timing isn't coincidental. Projected supply balances flip negative in 2027, then crater throughout the 2030s, approaching a staggering 15 million tonne shortfall by 2040.

Right now, the market looks relatively balanced. But that equilibrium is temporary. The deficit doesn't arrive overnight—it builds gradually, year after year, as demand from two massive sectors outpaces what mines can deliver.

Data Centers and Energy Transition Drive Unprecedented Copper Hunger

The demand story has two main characters: data centers and the energy transition. Both are copper-intensive on a scale that dwarfs traditional consumption patterns. AI infrastructure, renewable energy installations, electric vehicle charging networks—all require massive copper volumes that weren't factored into supply planning even five years ago.

The copper market moves into deficit from 2027, with balances deteriorating over time as structural demand from data centers and energy transition accelerates.

This isn't about temporary tightness from a single mine closure or short-term logistics issues. The chart accompanying the forecast frames this as a structural shortfall—the kind that persists and worsens unless major new capacity comes online. For deeper context on the copper supply-demand dynamics, see global copper demand and supply falling short and copper and lithium demand linked to the energy transition.

Market Implications: Rising Sensitivity Through 2027

The key takeaway for traders and strategists? Timeline sensitivity. A deficit starting in 2027 means the next three years become critical for supply planning, capacity expansion, and inventory positioning. With estimates pointing to deficits widening dramatically by 2040, expectations around mine development, recycling capacity, and end-market demand are now central to the HG copper narrative.

The U.S. inventory build signals that institutional players aren't waiting to see if forecasts prove accurate—they're already acting on them.

Peter Smith

Peter Smith

Peter Smith

Peter Smith