- How the CEO of Intel Started His Career Journey

- Building a Venture Capital Empire: The CEO of Intel's Early Success

- The Cadence Transformation: When the Future CEO of Intel Made His Mark

- The CEO of Intel Reaches His Peak: From Board Member to Chief Executive

- Current Wealth of the CEO of Intel: Net Worth and Financial Standing

- Core Success Principles: How the CEO of Intel Thinks About Achievement

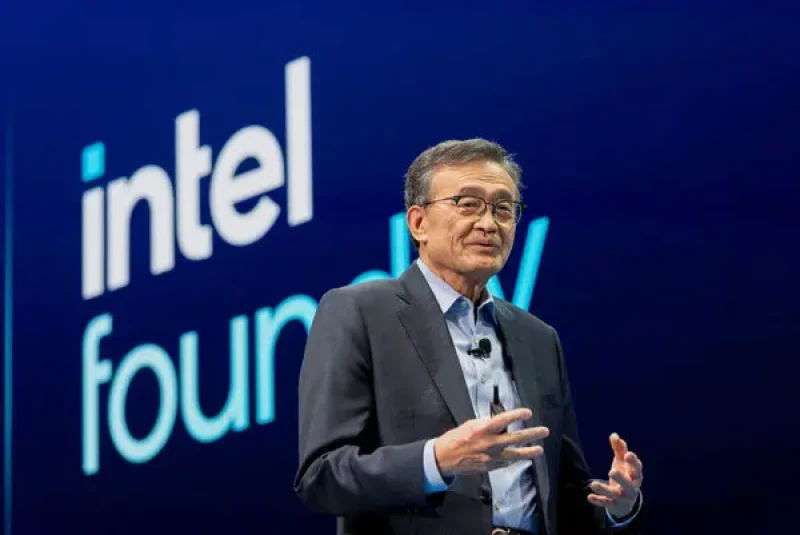

When Lip-Bu Tan walked through Intel's doors as the new boss in March 2025, he wasn't just taking on another executive role. He was stepping into one of the toughest jobs in Silicon Valley, tasked with rescuing a semiconductor giant that had lost its way. Unlike many corporate leaders who climb a single ladder to the top, Tan's journey reads more like an adventure story. From a small town in Malaysia to the helm of Intel, his path wound through venture capital goldmines and corporate turnarounds that made investors billions. Now, with the weight of Intel's future on his shoulders, this 65-year-old executive is betting he can pull off his biggest transformation yet.

How the CEO of Intel Started His Career Journey

Lip-Bu Tan didn't grow up dreaming about running a tech empire. Born on November 12, 1959, in the Malaysian town of Muar, he came from a family that valued brains over money. His dad ran a Chinese-language newspaper, while his mom worked at a university. After finishing high school, he headed to Singapore's Nanyang University and walked out with a physics degree in 1978.

But physics wasn't where the money was, at least not the way Tan saw it. He packed his bags for America and landed at MIT, where he earned a master's in nuclear engineering by 1981. Here's where things get interesting. Tan had his heart set on the nuclear power industry, figuring he'd make a comfortable living designing reactors. Then the Three Mile Island accident happened in 1979, and suddenly nobody wanted to build nuclear plants anymore. Talk about bad timing.

So Tan pivoted. He enrolled at the University of San Francisco for an MBA, which turned out to be the smartest move he ever made. His first real jobs were pretty ordinary by tech standards. He managed stuff at EDS Nuclear and ECHO Energy, then became a partner at a small investment fund called Walden USA. These weren't glamorous positions, and they definitely weren't making him rich. But they taught him how business actually works, which would matter a whole lot more than any physics equation he'd ever solved.

Building a Venture Capital Empire: The CEO of Intel's Early Success

In 1987, at just 28 years old, Tan did something gutsy. He took $20 million and started his own venture capital firm, Walden International. The name came from that Thoreau book everyone pretends to have read, and it perfectly captured Tan's whole vibe. While other investors were chasing whatever was hot, he went looking for opportunities everyone else ignored.

His big bet? Asian tech startups and semiconductor companies, back when most American investors thought both were bad ideas. "When semiconductors were not popular 20 years ago, I doubled down on it," he later said, and boy, did that pay off. By 2001, that initial $20 million had mushroomed into $2 billion. Forbes called him "the pioneer of Asian VC," which is fancy magazine speak for "this guy saw the future before everyone else."

The numbers tell the story better than any corporate press release ever could. Through Walden, Tan helped birth over 300 American companies and created roughly 50,000 jobs. The market value of companies he backed hit $400 billion. He took 40 companies public on U.S. stock exchanges and helped 66 others get bought out. Each successful exit meant more money in Tan's pocket, though he's never been the type to brag about his bank account. Still, this was when he started building serious wealth, the kind that lets you buy Intel stock by the million-share lot later on.

The Cadence Transformation: When the Future CEO of Intel Made His Mark

Getting rich from venture capital is one thing. Actually running a struggling company and turning it around? That's a different ballgame entirely. Tan got his chance in 2004 when Cadence Design Systems, a company that makes software for designing computer chips, asked him to join their board. Five years later, when Cadence was stumbling badly, they practically begged him to take over as CEO.

January 2009 was when Tan officially became Cadence's boss, right in the middle of the financial crisis. Not exactly ideal timing. The company was bleeding money, morale was in the toilet, and competitors were circling like sharks. But Tan did what he does best. He listened to customers, empowered his engineers, and cut through the corporate nonsense that was slowing everything down.

The turnaround was spectacular. During his 12 years running Cadence, revenue doubled. Operating margins got fat and healthy. And here's the kicker: the stock price went up more than 3,200 percent. If you'd invested $10,000 when Tan took over and held on until he stepped down in 2021, you'd have cashed out with over $320,000. By 2012, just three years in, Cadence's net worth had jumped to $1.3 billion, with $440 million of that coming in a single year.

As CEO of a major public company, Tan was finally making the kind of money that matched his reputation. His compensation packages included hefty salaries, performance bonuses, and stock options that became worth millions as the company soared. While exact figures fluctuated year to year, he was clearly in the top tier of tech executive pay.

The CEO of Intel Reaches His Peak: From Board Member to Chief Executive

Tan first got involved with Intel in 2022 when they asked him to join the board. Intel was struggling, everyone knew it, and they wanted his advice on how to fix things. But here's the thing about Tan: he's got opinions, and he's not shy about sharing them. By August 2024, he'd quit the board because he and then-CEO Pat Gelsinger couldn't see eye to eye on strategy. Tan wanted to split up Intel's manufacturing and design operations. Gelsinger didn't.

Fast forward a few months. Gelsinger was out, forced to "retire" after his turnaround plan flopped. Intel's stock had dropped 60 percent on his watch, the company had lost $16.6 billion, and nobody was happy. The board needed someone who could actually fix the mess, and suddenly Tan didn't look so crazy after all.

On March 12, 2025, Intel announced Tan as their new CEO, effective six days later on March 18. His compensation package is interesting because it shows how desperate Intel was to land him. Base salary: $1 million. Annual bonus potential: up to $2 million. Long-term stock and option awards: $66 million spread over several years. Plus, to show he meant business, Tan dropped $25 million of his own cash on Intel stock just three days after taking the job, buying over a million shares in one shot.

Current Wealth of the CEO of Intel: Net Worth and Financial Standing

These days, Tan's sitting on somewhere between $593 million and $1 billion, depending on who's counting and when they're counting it. That's the thing about net worth when you own a lot of stock in publicly traded companies. It bounces around based on market moods.

Where's all that money coming from? Well, he still owns about 1.4 million shares of Cadence, his old company. Since 2021, he's sold off 7.7 million Cadence shares for roughly $251 million. Then there's all the money he made from Walden International's successful investments over the years. And don't forget the board seats at other tech companies like Credo Technology and Schneider Electric, which pay pretty well for showing up to meetings and offering advice.

Now add in his Intel payday. That $1 million base salary sounds almost modest until you remember the bonus structure could double or triple it every year. The real money's in those stock awards worth $66 million, though they vest over time, meaning he can't just cash them out tomorrow. Industry folks figure Tan's pulling in somewhere between $15 million and $20 million annually from Intel alone when you add everything up, though the exact number depends on performance targets and where Intel's stock price lands.

For a guy who started out managing nuclear energy projects for a salary that probably wouldn't buy a decent car today, Tan's done alright for himself.

Core Success Principles: How the CEO of Intel Thinks About Achievement

Ask Tan about his success, and he'll give you three words: stay humble, work hard, delight customers. Sounds simple, almost too simple. But that's exactly his point. In his first message to Intel employees, he laid it out plain: "When you anchor yourself in those three core beliefs, good things happen. This has been true in every job I've ever had."

- The humble part isn't fake modesty. Tan genuinely believes he's not supposed to be the smartest guy in every room. "Leadership is not about being the smartest person in the room," he says. "It's about bringing out the best in others." He'd rather hire brilliant people and get out of their way than pretend he has all the answers himself. That lesson came from his college days playing basketball, where he figured out that trusting your teammates beats trying to be the hero every time.

- Then there's his whole contrarian thing. When everyone zagged, Tan zigged, and it made him rich. His big move was betting on semiconductors back when they were about as exciting as beige carpeting. While other investors chased internet companies and social media startups, he was putting money into chip design firms that nobody else wanted to touch. The result? 43 companies going public and 25 merger deals that made early investors very, very happy.

- But being contrarian doesn't mean being reckless. Tan's big on calculated risks, which he credits to a professor at MIT who drilled the concept into his head. "One of the things you will learn about me is that I am never deterred by challenges," he told people when he took over Intel. "Throughout my career, they have motivated me to solve hard problems." The key word is calculated. He takes big swings, but only after doing his homework.

- Tan's also obsessed with continuous learning. "You always have to constantly be learning," he says, which sounds like something you'd read on a motivational poster but actually makes sense coming from him. Venture capital forced him to become an expert in dozens of different industries because you can't invest in something you don't understand. He tells young professionals to turn every meal into a networking opportunity, meeting new people and picking their brains. Breakfast, lunch, dinner – all chances to learn something you didn't know yesterday.

- Maybe the most important thing, though, is his advice about authenticity. "Find out what is your core value and then what you believe in, and then stick to your core value," he says. "Be different, be yourself – you don't have to mirror image somebody else." That's not feel-good talk. Tan's whole career has been about doing things his way, whether that meant investing in Asian tech when nobody else would, taking the contrarian bet on semiconductors, or walking away from Intel's board when he disagreed with their strategy. He didn't get where he is by following someone else's playbook.

Now he's applying all those principles to the toughest job of his career. Intel's a mess, no question about it. The company that once dominated the chip industry has been getting its lunch eaten by competitors like Taiwan's TSMC and Korea's Samsung. Whether Tan can work his magic one more time remains to be seen. But if his track record means anything, betting against him would be a mistake.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov