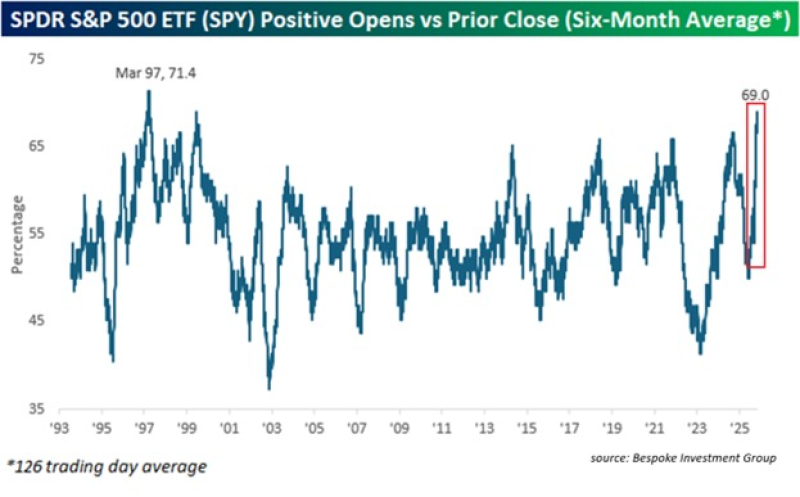

● The Kobeissi Letter recently pointed out something pretty remarkable: the S&P 500 ETF (SPY) has been opening in the green 69% of trading days over the last six months. That's the strongest showing since March 1997, when it hit 71.4%, based on data from Bespoke Investment Group.

● The numbers tell an interesting story. This six-month average of positive opens has jumped over 20 percentage points since April's low, showing a clear surge in buying interest. It's even edging past the levels we saw during the 1999 Dot-Com boom, which puts the current rally into historical perspective. The long-term average sits around 53%, so we're way above normal here.

● While this kind of strength shows serious investor confidence, analysts warn that readings this high don't usually last forever without at least a breather. When markets open positively nearly 70% of the time, it often means things might be getting stretched, which could set up some volatility if the mood changes.

● "The market is on fire," The Kobeissi Letter wrote, noting that SPY's momentum is now actually stronger than the late-90s tech surge. This consistent pattern of positive opens means traders keep betting on upside before the market even opens — likely fueled by solid earnings, cooling inflation, and hopes for favorable Fed policy moves.

Usman Salis

Usman Salis

Usman Salis

Usman Salis