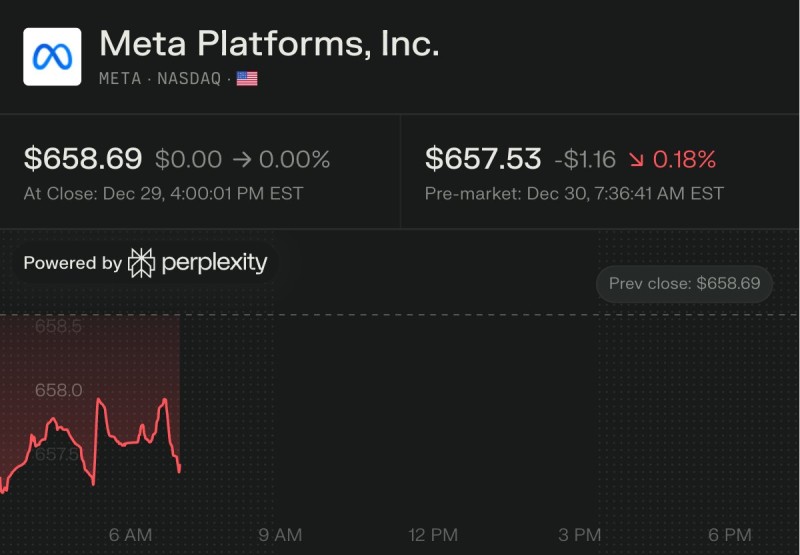

⬤ Meta's stock barely moved heading into the trading session, sitting at $658.69 and dipping slightly to $657.53 in premarket action—a 0.18% decline. The quiet reaction came as investors digested news about Meta's deal to buy Manus, an AI company that targets small and midsize businesses. Rosenblatt called Manus a "rocket ship grower" in the SMB-focused AI space, suggesting this pickup could matter more than the market's initial response indicated.

⬤ Rosenblatt put the Manus deal in pretty big company, comparing it to Meta's Instagram grab in 2012 and WhatsApp purchase in 2014. "This acquisition has the potential to stand alongside Meta's major acquisitions," the firm noted, though they acknowledged only time will show whether it reaches that level. If AI agents keep gaining traction with businesses, this move could reshape Meta's position in enterprise tech.

⬤ The natural connection here is WhatsApp's growing small business presence. Meta's messaging platform has become a go-to tool for SMB customer engagement, and Manus's AI capabilities could slot right into that ecosystem. Rosenblatt also tied the acquisition to Zuckerberg's broader vision of personal AI working across Meta's entire family of apps, positioning Manus as another piece in that long-term puzzle.

⬤ Meta continues pushing AI as a central strategy while trading in the mid-$650 range. The real test will be how smoothly Manus integrates and whether it actually moves the needle on Meta's growth numbers down the road.

Peter Smith

Peter Smith

Peter Smith

Peter Smith