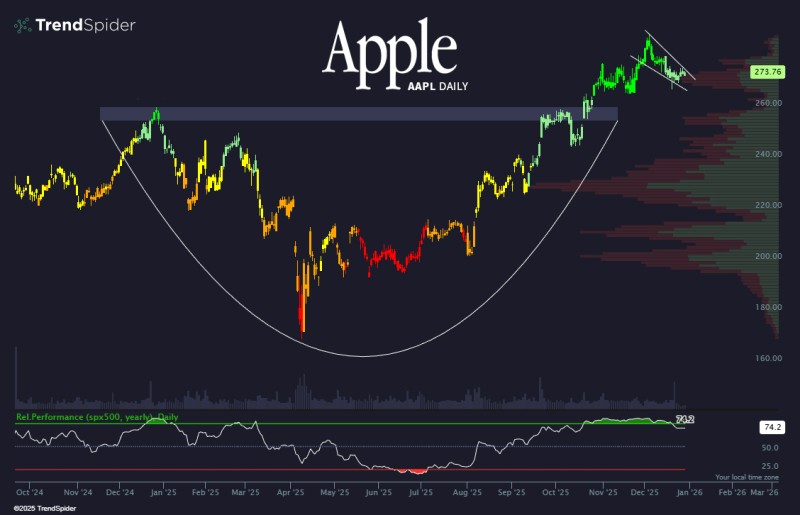

⬤ Apple Inc. (AAPL) is trading around $273.76, hovering near the top of its range after breaking through resistance around the $260 mark. The stock's currently taking a breather inside a downward sloping channel after completing a broad rounding base pattern that took several months to form. Market watchers note the consolidation looks healthy—AAPL cleared its previous resistance zone and now appears to be digesting those gains rather than reversing.

⬤ The chart shows Apple carved out a large rounded bottom earlier this year, gradually working its way back up to retest and eventually push through that $260 resistance band. After the breakout, price action tightened into a consolidation channel marked by converging trendlines—a typical pattern when a stock pauses to build energy for the next move. The narrowing range suggests traders are comfortable holding above breakout levels.

⬤ Technical readings add context to the setup. The RSI sits around 74, which shows strong momentum during the rally but has now leveled off as the stock consolidates—exactly what you'd expect when price takes a pause near overbought conditions. Volume profile data on the chart confirms healthy participation during the advance. Apple's holding its ground near record territory, and the key question now is whether this consolidation phase sets up another push higher or marks a temporary top.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets