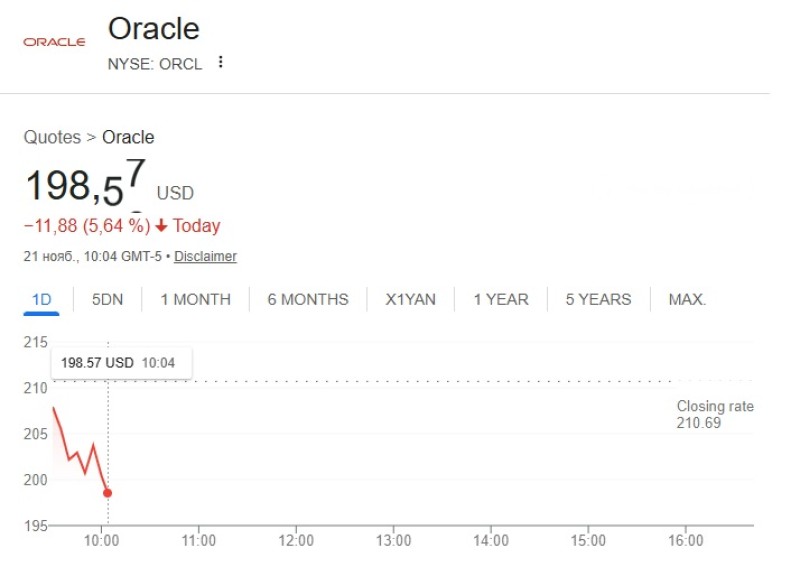

⬤ Oracle stock took a beating on Tuesday, crashing through the $200 mark in what can only be described as a brutal intraday drop. The move hammered $ORCL down more than 5 percent, with the chart showing a near-vertical selloff that dragged the price down to around $199.62. This breakdown punched through an important psychological level that had been holding up the stock pretty reliably.

⬤ What makes this particularly painful is how fast it happened. Oracle had been trading in a relatively calm range earlier in the session before everything just fell apart. The stock got absolutely crushed, dropping more than $11 in a single day—a 5.26 percent loss that left traders scrambling. The violent nature of the selloff suggests some serious panic selling kicked in once that $200 level gave way.

⬤ From a technical standpoint, this is bad news. That $200 support zone that was protecting Oracle? It's now resistance, and the stock tried multiple times to hold that level before finally breaking down. The speed and size of the drop points to either broader market panic or something sector-specific weighing on tech stocks. Either way, the message is clear: traders are running for the exits.

The breakdown occurred after multiple failed attempts to stabilize earlier in the session, highlighting intense selling pressure that overwhelmed buyers at key support levels.

⬤ Here's why this matters more than just another down day: when major stocks like Oracle break through important price levels, it doesn't just affect that one company. It shifts sentiment across the entire tech sector and can trigger broader repositioning. If Oracle can't reclaim $200 quickly, we might be looking at a deeper correction in large-cap tech names as the market reassesses valuations and risk tolerance.

⬤ My Take: This kind of vertical drop below a major psychological level rarely happens in a vacuum. The fact that Oracle couldn't hold $200 despite multiple attempts suggests institutional money is heading for the sidelines. If we don't see a quick bounce back above $200, this could mark the start of a more serious technical breakdown rather than just a one-day blip.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova