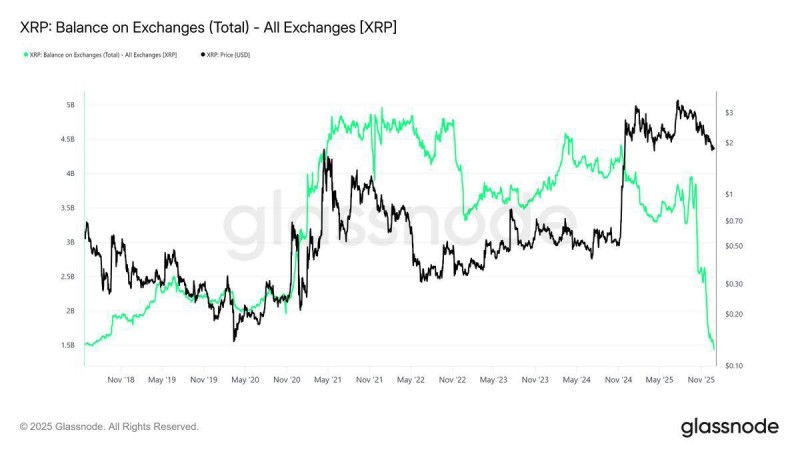

⬤ XRP supply held on centralized exchanges has dropped sharply to levels last seen in 2018, according to on-chain data from Glassnode. The latest chart shows that total XRP balance sitting on exchanges has fallen to around 1.6 billion tokens, down from approximately 3.76 billion earlier in the current market cycle. This means substantially fewer XRP tokens are immediately available to sell or trade through public exchange markets.

⬤ The Glassnode chart reveals a clear downward trend in exchange-held XRP during 2025, even as XRP's price has continued to fluctuate. Historically, declining balances on exchanges often signal tokens being moved to private wallets or long-term storage, which reduces visible sell-side liquidity. Larger market participants may increasingly be using over-the-counter channels, meaning some accumulation activity might not show up in exchange price action. Meanwhile, discussions continue around institutional demand and ETF-linked flows potentially reducing circulating supply.

⬤ Current market conditions may reflect an accumulation period during price consolidation, with smaller retail traders potentially getting shaken out while large holders reduce liquid supply. The verifiable on-chain data confirms that XRP exchange balances have dropped steadily throughout the cycle. XRP has experienced similar liquidity shifts in previous years, and traders continue watching whether reduced available supply could influence price dynamics once demand picks up. Broader macroeconomic factors and sentiment across the crypto sector also remain important to XRP market behavior.

⬤ The steep drop in on-exchange XRP levels is notable because it may affect market liquidity and price stability if demand increases while available supply continues shrinking. Reduced balances can sometimes lead to sharper price reactions when trading volume expands. At the same time, the data may signal a strengthening long-term holder base. Market participants are now watching to see whether this decline in readily tradable XRP aligns with renewed demand flows, which could play a key role in shaping XRP's next price direction.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov