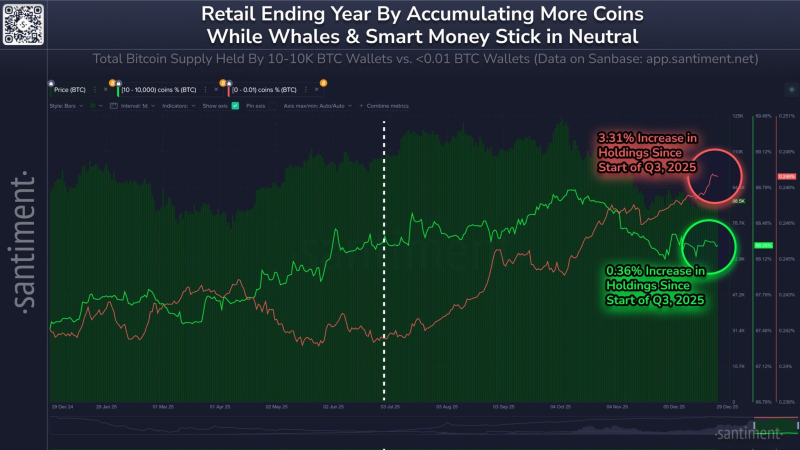

⬤ Smaller Bitcoin holders have been quietly building positions while the big fish mostly sat still. Wallets with less than 0.01 BTC bumped their share of total supply by 3.31% from early Q3 through year end, according to Santiment's tracking. Meanwhile, the whale tier—wallets holding 10 to 10,000 BTC—added only 0.36% during the same stretch. That's a pretty clear split in who's been buying and who's been watching.

⬤ The chart tracking both groups through the second half of 2025 shows retail accumulation climbing steadily, while whale balances stayed flat for most of the period before ticking up slightly in late Q4. That's different from typical bull runs, when whales usually stack harder. This time around, the little guys are outpacing the supposed smart money by a wide margin percentage-wise.

⬤ Bitcoin spent much of the past several months consolidating rather than ripping higher, but retail wallets kept adding anyway. The 3.31% uptick among the smallest holders stands out against the 0.36% bump from whales. It suggests everyday buyers stayed committed even without major price action, while larger players held back or kept positions steady instead of loading up aggressively.

⬤ Ownership structure shifts like this can hint at what different market participants are thinking. When retail keeps stacking and whales stay neutral, it might mean smaller holders see value here while bigger money waits for clearer signals or better entry points. How this pattern develops could shape liquidity, supply pressure, and what happens next with Bitcoin's price.

Usman Salis

Usman Salis

Usman Salis

Usman Salis