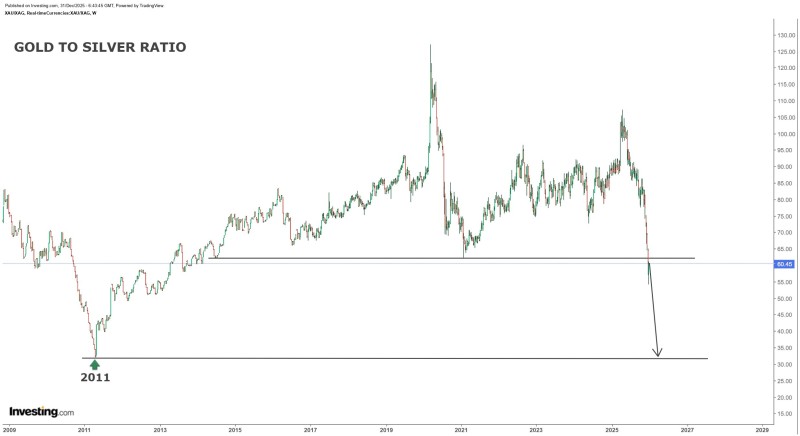

⬤ The Gold to Silver Ratio (XAU/XAG) has been sliding fast, showing silver is gaining serious ground on gold. The ratio just hit an initial target around 60, clearly visible on the chart. What's grabbing attention now is the next potential milestone: the 2011 low near 32, last seen during silver's previous major surge.

⬤ The numbers tell an interesting story. If gold trades at $5,500 and the ratio drops to 32, silver would be worth roughly $171. Push gold to $7,000 with that same ratio, and silver jumps to about $218. Both metals still have plenty of room to run in this cycle, though many traders might be underestimating just how explosive silver's move could get. Of course, this isn't investment advice—just food for thought.

⬤ The weekly chart paints a clear picture: the ratio has dropped sharply from multi-year highs down to the 60.45 zone. There's a support area marked near that level, with the lower target at 32 sitting well below. The speed of this decline shows how quickly silver has been flexing its muscles against gold lately.

⬤ Why does this matter? When the Gold/Silver ratio falls like this, it signals a real shift in how these two metals are performing against each other. Silver outperforming gold often means traders are getting more aggressive, expectations are changing, and activity across the metals market is heating up. If the ratio actually reaches that 32 level again, we'd be looking at a major repricing between gold and silver—something that could shake up sentiment and positioning throughout the entire precious metals space.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi