Nvidia (NVDA) market value has reached 16% of the entire U.S. economy—a staggering figure that reflects how deeply AI has reshaped the global financial landscape. This isn't just about a tech company doing well; it's about a fundamental shift in where economic power is concentrated. Nvidia has become the engine room of the AI age, and its rise shows how compute power has become the defining resource of our time.

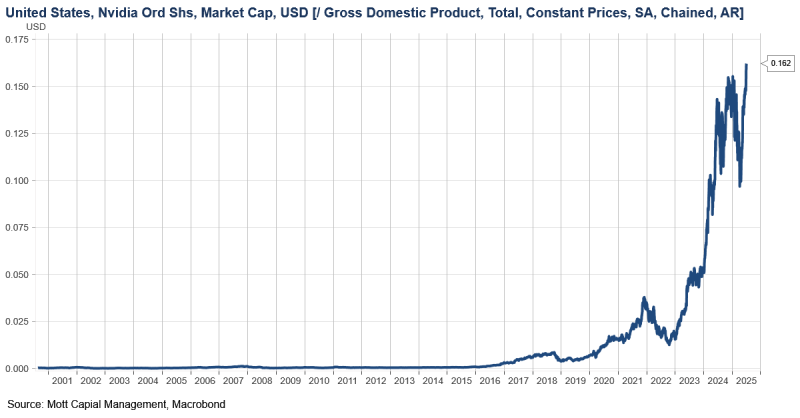

Chart Analysis: Nvidia's Market Cap Outpaces U.S. GDP Growth

The visualization shared by Barchart, based on data from Mott Capital Management, shows Nvidia's market cap as a percentage of U.S. GDP from 2000 to 2025. For most of those years, the line barely moves, hovering near zero as the company remained largely confined to gaming and graphics.

Around 2016, the line begins climbing as GPUs found new purpose in machine learning. By 2020, the trajectory steepens. After the AI boom takes off in 2023, the curve goes nearly vertical.

As of early 2025, Nvidia's valuation stands at roughly 16% of total U.S. GDP—an unprecedented ratio for any single company in American history.

Here's what the timeline reveals:

- From 2000 to 2015, Nvidia's growth was modest and tied mainly to consumer and gaming demand.

- Between 2016 and 2021, the company saw consistent gains as GPUs became essential for machine learning and data centers.

- From 2023 to 2025, AI infrastructure demand exploded, pushing Nvidia's valuation to move in lockstep with global AI investment cycles.

What's Driving Nvidia's Historic Rise

Nvidia controls the most critical asset of the AI era: computing power. Its GPUs are the backbone of nearly every major AI system today, from ChatGPT to autonomous vehicles. Major cloud providers—Amazon, Microsoft, Google—are spending billions on Nvidia hardware for generative AI workloads. Data centers have become Nvidia's largest revenue source, with year-over-year sales jumping over 200% in recent quarters.

Markets now view Nvidia less as a hardware company and more as foundational infrastructure—comparable to what oil companies were during the industrial revolution. The company has effectively become the fuel supplier for the AI economy.

The Bigger Picture: When a Company Rivals an Economy

Nvidia's 16% share of U.S. GDP exceeds any precedent in recent history. During the dot-com boom, Cisco peaked at around 6% of GDP. In 2021, Apple briefly touched 10%. Nvidia has blown past both, setting a new record for corporate concentration relative to national output.

This signals a deeper economic transformation. AI and compute capacity are replacing traditional drivers like energy and manufacturing as the core engines of productivity. Nvidia sits at the center of that rewiring.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi