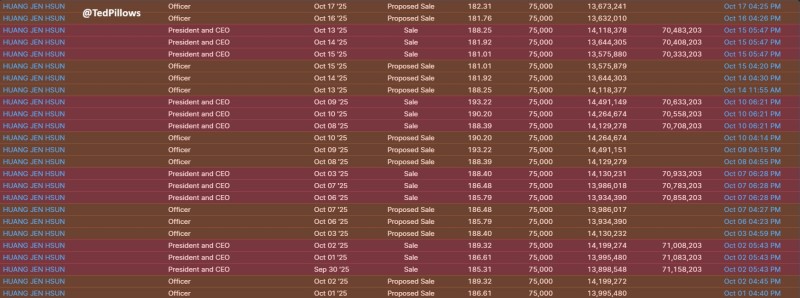

Insider filings this month reveal that Nvidia (NVDA) CEO Jensen Huang has been executing multiple share sales as the company sits atop global market capitalization rankings. Each transaction involves 75,000 shares and totals hundreds of millions of dollars, catching the attention of investors already watching Nvidia's sky-high valuation closely. The sales have been occurring almost daily since early October through mid-month.

While insider selling doesn't automatically mean internal pessimism - it often reflects tax planning, portfolio diversification, or pre-scheduled trading plans - the frequency and consistency of these transactions are worth noting as Nvidia trades near all-time highs.

What the Filings Show

Trader Ted highlighted the systematic pattern of sales and proposed sales between October 1 and October 17, 2025. Every transaction involved exactly 75,000 shares priced between $181 and $193 per share, bringing in proceeds exceeding $1.3 billion over the period.

The forms identify Huang as both President and CEO, suggesting these transactions are running through a structured 10b5-1 trading plan—a legal framework that automates sales to prevent insider-trading issues. Even so, the uniformity and size of the transactions naturally draw attention when they line up with record-breaking valuations.

Key details:

- Consistent execution of 75,000-share blocks sold nearly every day

- Price range of $181–$193 per share

- Mix of completed sales and proposed sales, indicating scheduled liquidation

- Despite the sales, Huang still holds over 70 million shares, maintaining a significant personal stake

Nvidia's Record Valuation

Nvidia has reached a valuation that few companies in history have achieved—surpassing $3 trillion and briefly overtaking Apple as the world's most valuable public company. The surge has been fueled by explosive AI demand, GPU market dominance, and data-center growth that's outpaced nearly every tech competitor.

From a technical standpoint, NVDA stock has been trading in a range between $180 and $195, staying near all-time highs after several quarters of gains. While the uptrend is still intact, momentum indicators show signs of cooling, and insider sales could add to caution among traders looking for a potential pullback.

Why Executives Sell

Corporate executives regularly sell shares for reasons that have nothing to do with their company's outlook. Common reasons include tax obligations from exercised stock options, portfolio diversification to reduce concentration risk, and planned transactions under SEC Rule 10b5-1 established months ahead of time.

In Huang's case, the pattern and scale align with long-term financial planning. But investors often read clustered sales near valuation peaks as a possible sentiment shift, especially when paired with plateauing technical momentum.

Market Reaction and What's Next

Nvidia remains the clear leader in AI chip technology, but broader market factors could influence how investors interpret Huang's moves. Rising competition from AMD and Intel, potential U.S. export restrictions to China, and tightening monetary conditions all add layers of uncertainty.

Still, analysts remain optimistic about Nvidia's fundamentals - particularly its Blackwell architecture, which is expected to fuel another wave of AI infrastructure spending through 2026. Short-term traders might see the insider activity as a sign of cooling enthusiasm, while long-term investors are more likely to view it as routine financial management from a CEO whose wealth is almost entirely tied to one company.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov