⬤ India's power sector hit a turning point in 2025. Coal-based electricity output fell 3%—the first drop unrelated to a pandemic in at least half a century. Even as total installed capacity kept growing, the country started meeting rising electricity demand in a fundamentally different way.

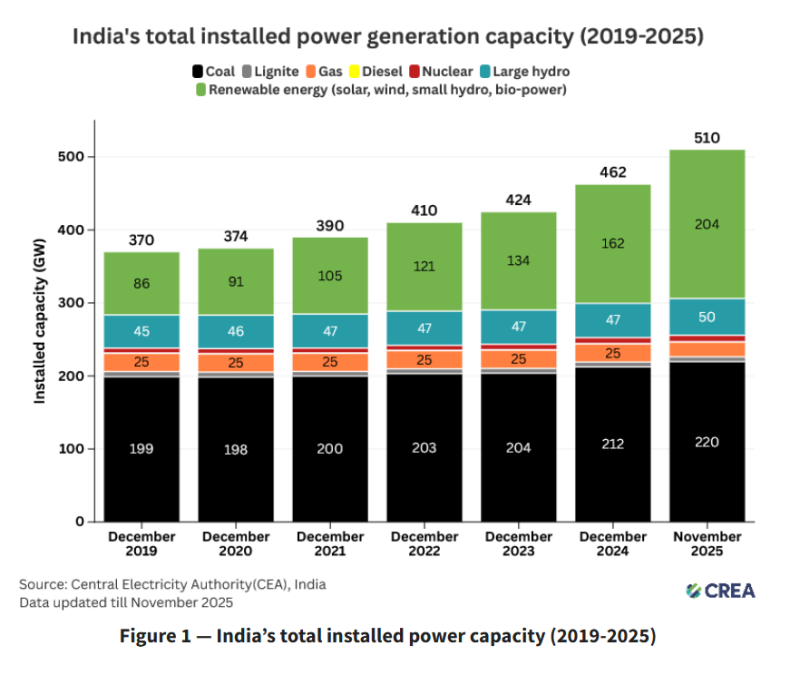

⬤ Total installed power generation capacity climbed from roughly 370 gigawatts in 2019 to about 510 gigawatts by November 2025. Renewables drove this expansion, more than doubling from around 86 gigawatts to approximately 204 gigawatts. Meanwhile, coal capacity inched up modestly from about 199 gigawatts to roughly 220 gigawatts. The key detail: coal output declined even though coal capacity increased, meaning existing plants simply ran less.

⬤ The game-changer was India's record installation of nearly 42 gigawatts of renewable capacity in 2025 alone, with solar and wind dominating new additions. As renewables captured a bigger slice of actual electricity generation, coal plants operated at lower rates. Demand kept rising, but coal wasn't needed to meet it.

⬤ This shift carries weight beyond India's borders. As one of the world's largest coal consumers and fastest-growing electricity markets, India's trajectory influences global fuel demand and emissions patterns. The 2025 numbers show renewable expansion isn't just adding capacity anymore—it's actively reducing coal generation. That's a real inflection point in the country's energy transition.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah