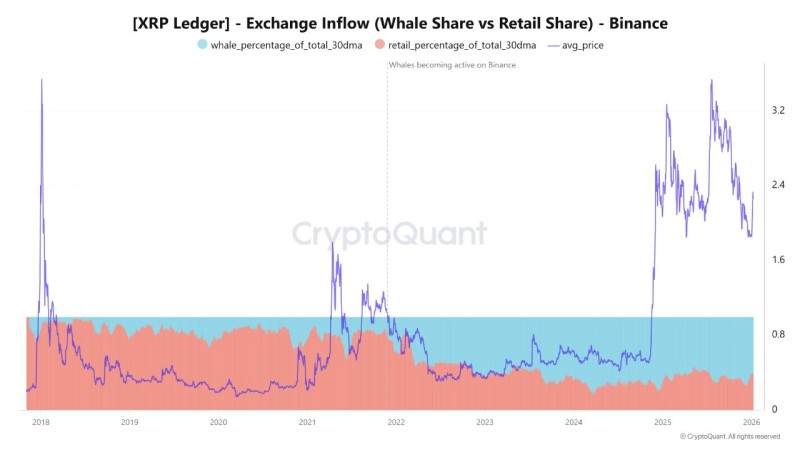

⬤ XRP's exchange activity is showing a clear shift—whales are moving more coins while everyday traders are stepping back. Looking at Binance's 30-day moving average, whale inflows are climbing while retail participation keeps shrinking. This isn't just noise in the data. History shows this exact pattern tends to show up right before XRP makes big moves.

⬤ Go back to 2021, and you'll see the same story. When whale inflows started dominating the charts, XRP's price followed with a sharp rally that pushed past $1.96. Fast forward to late 2024, and it happened again—whale activity picked up as retail faded out, and XRP jumped from around $0.50 straight up to nearly $3.29. Both times, the big players got active early, right as price momentum was building.

⬤ Right now, the data's telling a similar story. Whale share of total 30-day inflows is trending up while retail keeps getting squeezed down. The difference this time? It's happening during active price swings rather than quiet consolidation periods. XRP hasn't hit those previous cycle highs yet, but the inflow patterns look almost identical to those pre-rally phases when whales started loading up on exchanges.

⬤ Why does this matter? Because when whales and retail traders shift positions, it changes how the market moves. More whale inflows usually mean repositioning is happening, especially on major platforms like Binance. Given that these same inflow patterns lined up with XRP's biggest price expansions before, traders are keeping close watch on how this structure develops as market momentum keeps shifting.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets