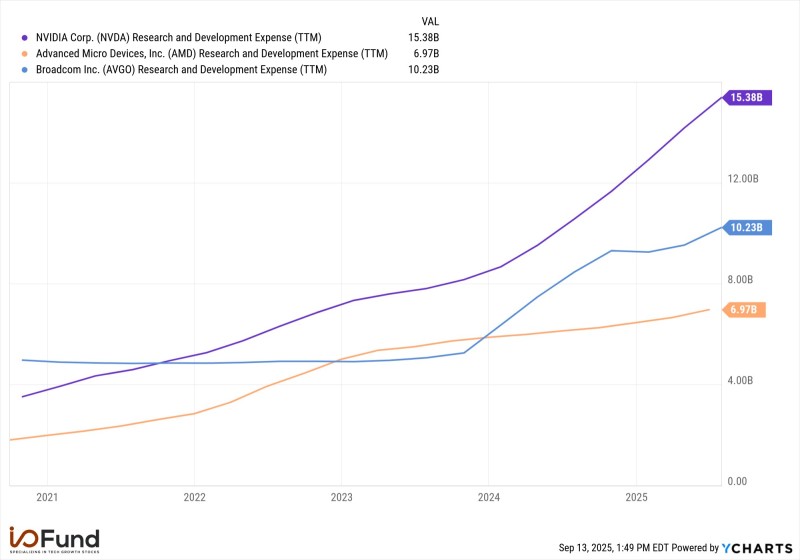

The artificial intelligence chip market is heating up, and research spending has become the ultimate battlefield. While Nvidia continues to dominate AI revenue streams, recent data reveals a surprising trend: the company's research and development advantage isn't as insurmountable as many believe. Broadcom and AMD are rapidly closing the gap, setting the stage for an increasingly competitive landscape.

Nvidia's Research Dominance Shows Cracks

Over the past twelve months, Nvidia has poured $15.38 billion into research and development—a massive figure that still leads the pack. However, the margin isn't as wide as you might expect. Broadcom sits at $10.23 billion, while AMD has reached $6.97 billion, according to analysis by Beth Kindig.

This narrowing gap raises serious questions about whether Nvidia can justify its premium valuation if competitors continue ramping up their innovation investments at this pace.

Breaking Down the Numbers

Looking at the growth trajectories from 2021 to 2025, three distinct patterns emerge:

Nvidia's Aggressive Push: The purple line shows a dramatic spike starting in 2023, with R&D spending shooting past $15 billion. This reflects heavy investments in AI infrastructure, autonomous driving technology, and data center capabilities.

Broadcom's Breakout Moment: After remaining relatively flat through 2021-2022, Broadcom's blue line shows an explosive surge in 2023-2024, reaching $10.23 billion. This leap past AMD signals serious intent in the AI infrastructure space.

AMD's Steady Climb: The orange line represents consistent, measured growth to $6.97 billion. While less dramatic than its competitors, this disciplined approach spans CPU, GPU, and AI accelerator development.

The message is unmistakable: while Nvidia still holds the lead, its competitors are gaining ground faster than ever before.

What This Means for Investors

The shifting R&D landscape carries significant implications. Nvidia's stock commands a hefty premium based largely on its technological leadership, but if Broadcom and AMD successfully convert their increased spending into market share, that premium could be at risk. Broadcom's rapid scaling particularly stands out as a potential game-changer in AI networking infrastructure, while AMD's balanced approach across multiple chip categories positions it as a versatile competitor.

With global AI demand exploding across industries, sustained research investment will likely determine market leadership for the next decade. Innovation capacity, not just current revenue, may become the primary driver of long-term success.

The Road Ahead

Nvidia maintains its research spending crown, but the competitive dynamics are undeniably shifting. Broadcom's surge and AMD's methodical progress mean the AI chip race is becoming a true multi-player competition. Investors should brace for a more dynamic market where technological breakthroughs, rather than existing market position, will ultimately determine the winners.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah