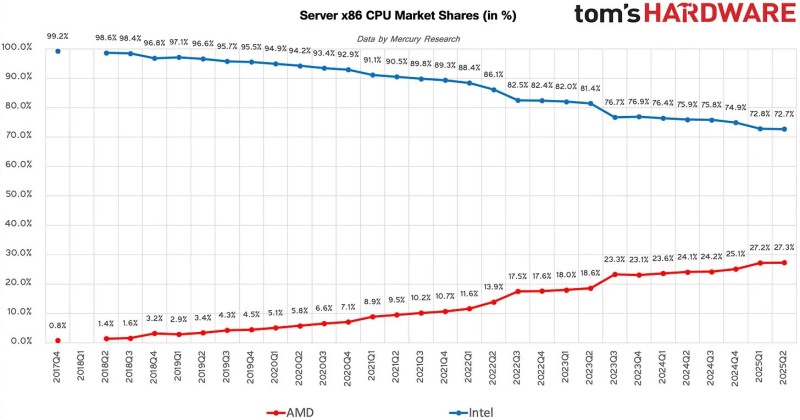

The server CPU market is witnessing one of the most dramatic competitive shifts in tech history. Eight years ago, Intel held a virtual monopoly with 99.2% market share, while AMD barely registered at 0.8%. Today, that landscape looks completely different. AMD now commands 27.3% of the market, while Intel has dropped to 72.7% - a stunning reversal that highlights how quickly fortunes can change in the semiconductor industry.

This transformation represents more than just market share numbers. It reflects a fundamental shift in how enterprises view CPU choices and signals the end of Intel's unchallenged reign in server processors.

The Great Market Shift

The decline has been steady and relentless. Intel's market share has trended downward almost every quarter since 2017, breaking below the crucial 80% threshold in 2023 before stabilizing just above 70% in 2025. Meanwhile, AMD's rise tells the opposite story, with key breakthrough moments that changed everything.

According to analyst Ray Myers, the turning point came between 2020 and 2021 when AMD crossed the 10% barrier, proving that enterprises were willing to trust an Intel alternative for critical workloads. The momentum accelerated through 2022 and 2023 as AMD surpassed 20% market share, transforming from an alternative option into a serious competitor. By 2025, AMD's climb past 27% represents a milestone that seemed impossible when Intel controlled nearly the entire market.

What's Driving AMD's Success

- Superior processor technology with EPYC chips built on advanced manufacturing processes

- Intel's manufacturing delays that weakened their competitive position

- Major cloud providers like AWS, Azure, and Google choosing AMD for better performance and costs

- Growing enterprise confidence in AMD as a reliable long-term partner

- Better performance-per-watt ratios that matter for data center efficiency

The shift reflects both AMD's execution excellence and Intel's stumbles. While Intel struggled with manufacturing transitions, AMD partnered with TSMC to deliver cutting-edge processors that often outperform Intel's offerings while consuming less power.

Looking Ahead

AMD's trajectory suggests 30% market share could be within reach by 2026 if current trends continue. For Intel, holding the 70% line has become critical - falling below this level would signal an even more dramatic loss of market control. The competition has fundamentally changed the industry dynamics, forcing both companies to innovate faster and compete harder.

What we're witnessing isn't just a temporary market correction but a permanent shift in the server CPU landscape. The days of Intel's monopoly are over, replaced by genuine competition that ultimately benefits customers through better products and pricing.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah