Nvidia's earnings week is shaping up to be a make-or-break moment for the AI darling that's captivated Wall Street for the past two years. With the chip giant scheduled to report on August 27, 2025, all eyes are on whether the company can maintain its blistering growth pace or if cracks are starting to show in the AI boom narrative.

The stakes couldn't be higher. Nvidia has become synonymous with artificial intelligence investing, and its quarterly reports have evolved into market-wide events that can spark rallies or trigger selloffs across the entire tech sector. This time around, options traders are bracing for significant movement, and the numbers tell a compelling story about just how much uncertainty surrounds the upcoming announcement.

NVDA Price Set for a Big Earnings Week

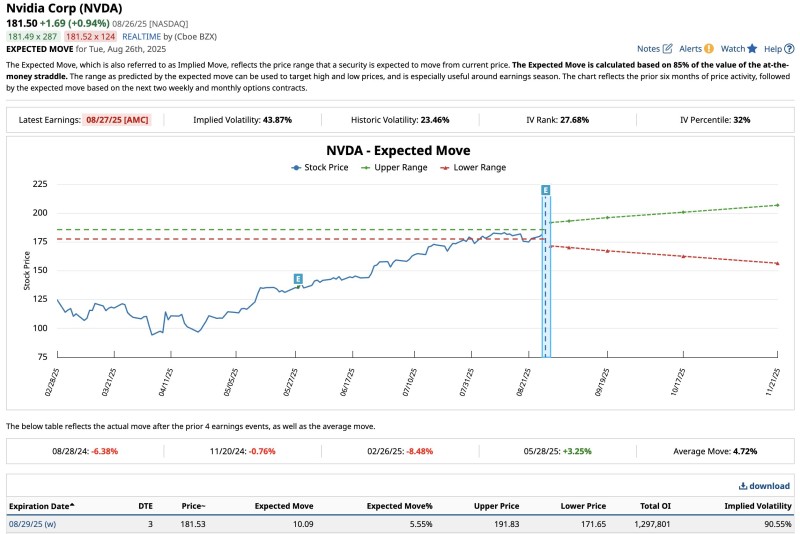

Here's what the smart money is betting on: Nvidia shares are about to get wild. According to trader @Barchart, options markets are pricing in a hefty 5.55% move when the dust settles after earnings. With NVDA sitting at $181.50, that puts the expected trading range between $171.65 and $191.83.

Those aren't small numbers when you're talking about a company worth hundreds of billions. A move to either end of that range could add or subtract tens of billions from Nvidia's market cap overnight.

Options Market Implies Major NVDA Price Shift

The options market is practically screaming that something big is coming. Implied volatility has spiked to 43.87%—nearly double the stock's typical 23.46% historical volatility. When options traders are willing to pay premium prices like that, they're betting on fireworks.

Recent earnings have certainly delivered the drama. February's report sent shares tumbling 8.48%, while May brought a more modest 3.25% bounce. Over the past four quarters, Nvidia has averaged a 4.72% post-earnings move, so this week's expectations are running slightly hot compared to recent history.

What's Next for NVDA Price After Earnings?

The beauty—and terror—of earnings season is that anything can happen. Beat expectations and raise guidance? NVDA could easily blast through $192 and keep climbing. But stumble on revenue growth or offer lukewarm forward guidance, and that $171 floor might not hold.

Smart options traders are watching more than just the stock price. They're eyeing implied volatility too, because once earnings hit, that elevated volatility typically crashes back down. Anyone playing volatility strategies better have their exit plans ready.

Peter Smith

Peter Smith

Peter Smith

Peter Smith