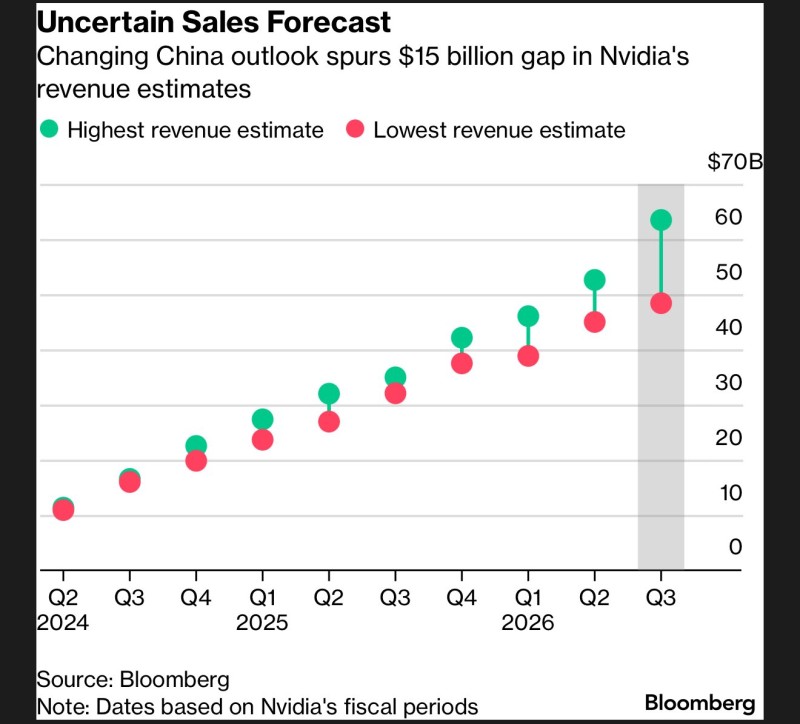

The semiconductor giant that's been Wall Street's darling is now facing its biggest forecasting challenge yet. Nvidia's revenue projections have become a battleground for analysts, with estimates spanning an unprecedented $15 billion range as uncertainty around China's semiconductor market reaches fever pitch. This massive divergence in analyst opinions reflects deeper concerns about geopolitical risks and the sustainability of AI chip demand in one of the world's largest markets.

Traders Sound the Alarm on Record Revenue Uncertainty

Market observers are taking notice of this unusual development. Trader @TradingThomas3 recently highlighted how Nvidia is experiencing the widest analyst revenue gap in years, pointing to growing concerns about the company's China exposure through H20 chip sales. The Bloomberg data reveals a stark reality: Q3 2026 revenue estimates now range from approximately $45 billion at the low end to nearly $60 billion at the high end.

This isn't just statistical noise – it's a reflection of genuine uncertainty about how China's regulatory environment will impact Nvidia's business. The H20 chips, specifically designed for the Chinese market to comply with export restrictions, represent a significant revenue stream that analysts are struggling to quantify. Some bulls believe demand will remain robust despite regulatory headwinds, while bears worry that tightening restrictions could severely impact sales.

Market Volatility Signals Investor Nervousness

The stock market rarely tolerates uncertainty well, and Nvidia's share price has become increasingly sensitive to any news regarding China relations or revenue guidance updates. This volatility isn't surprising given that institutional investors are grappling with the same questions that have analysts so divided. The quarterly earnings calls have become high-stakes events where every comment about China demand gets scrutinized for clues about future performance.

What makes this situation particularly challenging is that traditional forecasting models struggle with geopolitical variables. Unlike typical supply and demand dynamics, regulatory decisions can shift overnight, making it nearly impossible to predict with confidence. This uncertainty premium is now baked into Nvidia's valuation, creating both opportunity and risk for investors willing to navigate these turbulent waters.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah